MARHARYTA MARKO/iStock via Getty Images

The sports betting industry has the potential to grow to $140B in size by 2028, and Penn National Gaming (PENN) is my favorite way to capitalize on this unique opportunity. PENN does not only have the Barstool brand name to strategically attract a young audience to its platforms, but it is also free-cash flow positive and supports a healthy net income margin, both of which are hard to come by given how new the sports betting industry is. PENN’s Barstool Sportsbook has made its way into 11 states, 10 of which have lower than average tax rates, increasing its ability to turn a profit. PENN has also managed to grow its top line despite the headwinds of a global pandemic. Revenues were 10% higher in Q3-21 versus Q3-19 (pre-pandemic), showing PENN’s resiliency. And, even with the increased costs of launching its Barstool Sportsbook, PENN was still able to generate $86 million in net income. This was an increase of 87% from pre-pandemic Q3-19 levels. Such impressive financial growth warrants a closer look and deeper analysis. I am here to give you the inside scoop on PENN shares and walk you through my 83% upside case for the stock.

PENN owns and operates casinos and horse racetracks, with 44 facilities across 20 states. The company also owns 36% of Barstool Sports through a strategic partnership, with Barstool being the sole promotor of PENN’s land-based operations. PENN makes money through two operating segments: «Gaming» which made up 83% of revenues in Q3-21 and «Food, beverage, hotel, and other» which made up the other 17% of revenues in Q3-21. PENN’s gaming segment represents the revenues generated through casinos and racetracks. Within this segment, slot machines generate the majority of revenue, with 87% of gaming revenue coming from slots at its properties. The company was founded in 1972 and is headed by its CEO, Jay Snowden.

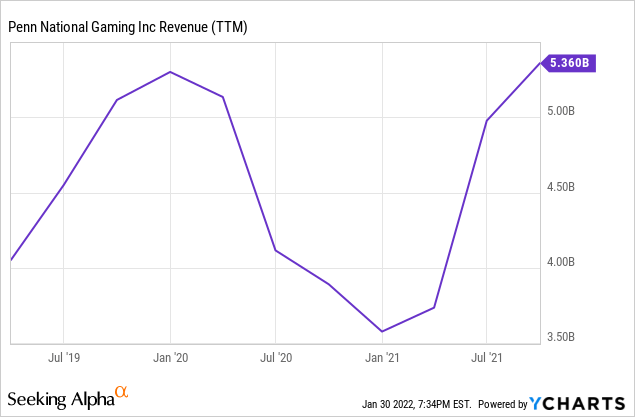

Despite the COVID-19 pandemic limiting in-person gambling, PENN has shown that it is resilient on both its top and bottom lines. As mentioned, PENN reported revenues of $1.5B, up 10% since Q3-19. EBITDA also came in hot, reported at $480M, 17% higher than Q3-19. The fact that PENN has been able to report higher revenues and EBITDA than its pre-pandemic levels is a testament to the resiliency of the company.

This is a chart of PENN’s revenues since 2019, exemplifying the company’s resiliency to COVID-19 imposed lockdowns (that the company is swiftly moving past).

Not only have revenues and EBITDA been strong, but also PENN’s bottom line has held up remarkably well.

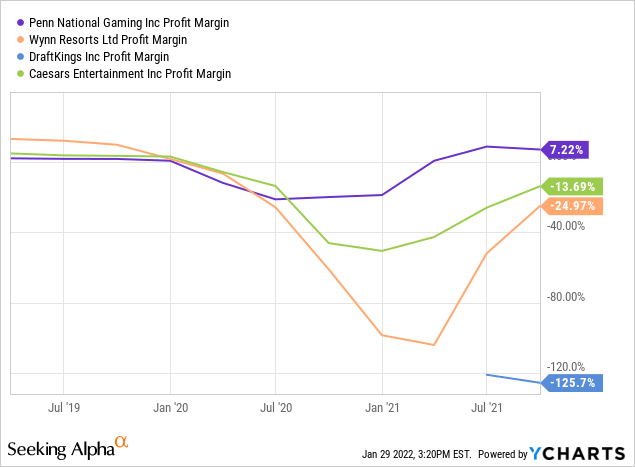

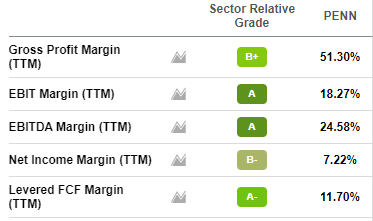

PENN has a 7.22% TTM net income margin while its competitors are all struggling to make a profit.

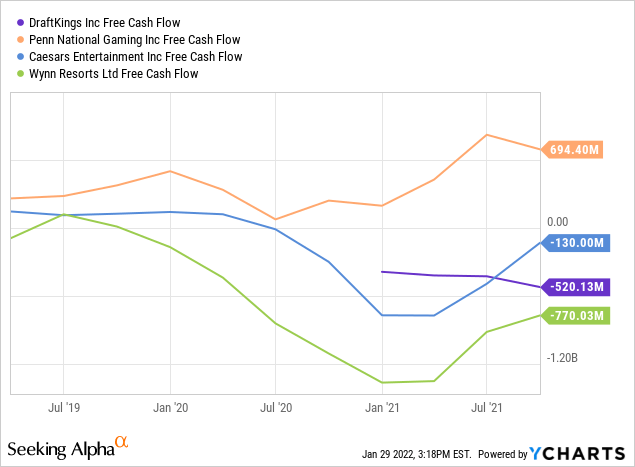

I am also optimistic about PENN’s free cash flow standing, generating $694.4M of TTM free cash flow as of Q3-21.

This gives PENN a massive advantage to its competition as it can increase capex and maintain its healthy balance sheet without taking on increased debt burdens to finance its operations.

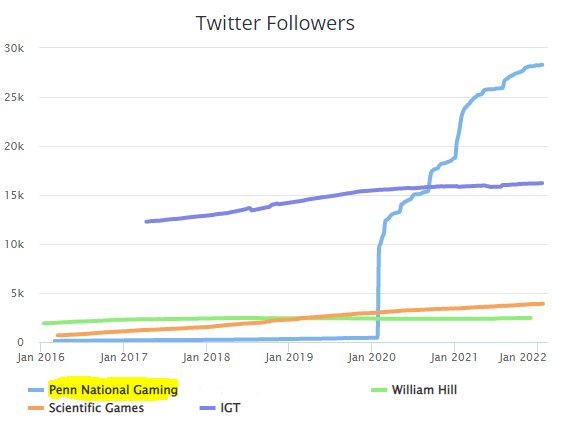

PENN gained the exclusive right to Barstool’s strong brand in 2020 after investing $163M (a 36% equity stake) into the sports media agency. Now that Barstool is solely marketing PENN’s «Barstool Sportsbook,» the company has seen an increased twitter following, magnitudes ahead of some of its peers.

Twitter Followers For PENN National Gaming vs Competing Gambling Companies (Craft.co)

Above is PENN’s twitter follower growth versus some of its alternatives. As you can see, PENN has successfully grown its Twitter following, a primary way the company attracts users to its platform.

Twitter Followers For PENN National Gaming vs Competing Gambling Companies (Craft.co)

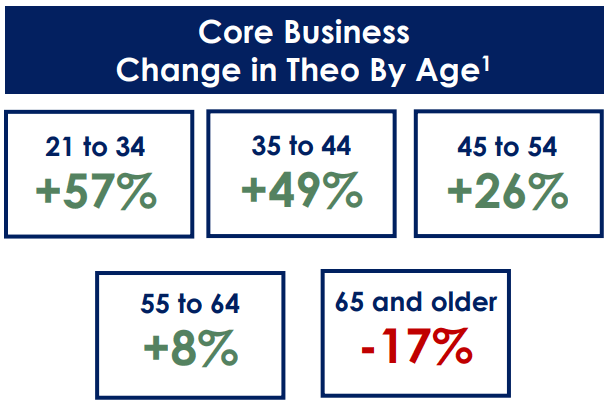

I am also encouraged by the young age demographic of these users which will help to generate revenues for years to come.

Change In Core Business By Age (Q3-21 Investor Presentation)

Change In Core Business By Age (Q3-21 Investor Presentation)

The mobile application has attracted a lot of attention, showing in its 4.8 stars and 13,000+ ratings on the app store.

Barstool Sportsbook App Rating (Q3-21 Investor Presentation)

Barstool Sportsbook App Rating (Q3-21 Investor Presentation)

A user-friendly interface and experience are musts on any mobile application and PENN’s Barstool Sportsbook & Casino app is clearly receiving positive feedback on both fronts.

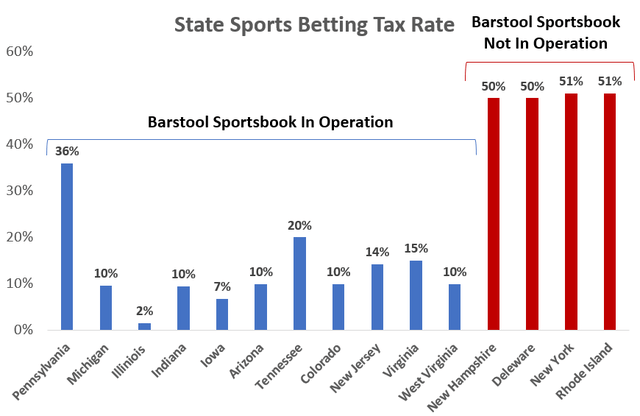

Now that sports betting is being adopted nationwide, some states are more lenient on tax rates than others. For example, the New York sports betting market reportedly generated $1.2B of handle in its first 16 days, with Caesars (NASDAQ:CZR), FanDuel (DUEL), and DraftKings (NASDAQ:DKNG) capturing 41.5%, 30.6%, and 22.6% respectively. Although this hot market is off to a great start in terms of the massive amount of betting already taken place, for the companies serving customers, chances of profitability look slim. This is because of the 51% tax rate that the state charges on winnings. This goes for several other states including Delaware, New Hampshire, and Rhode Island. While PENN has not yet gained approval in New York, I view this as positive for overall profitability as PENN has instead released its sportsbook in states with lower tax rates on winnings. This is shown in the chart below.

State Sports Betting Tax Rates (Tax Foundation)

State Sports Betting Tax Rates (Tax Foundation)

As you can see, PENN is operating in states with lower tax rates, making profitability easier. This is reflected in the company’s profitability metrics which are strong relative to their sector.

PENN Profitability (Seeking Alpha)

PENN Profitability (Seeking Alpha)

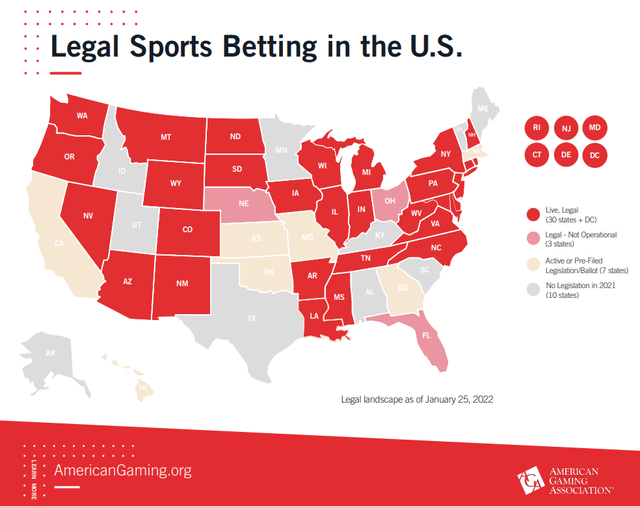

I also see massive growth opportunities in states that have legalized sports betting, but PENN has not launched its sportsbook yet. Shown below is a map of which US states have legalized, which have not, and the extent to which regulations are beginning to be implemented.

US Map Of Sports Betting Legalization (AmericanGaming.org)

US Map Of Sports Betting Legalization (AmericanGaming.org)

30 states are currently live and legal for sports betting. With PENN’s Barstool Sportsbook live in only eleven states currently, this represents a massive growth opportunity for the company to continue expanding its operations.

I believe that PENN shares are ~83% undervalued from current levels. PENN shares have been caught up in the broader risk-off period driving equity markets lower and therefore investors should take this as an opportunity to begin accumulating shares. The main rationale for my valuation is higher than consensus revenue forecasts driven by continued launches of PENN’s sportsbook in newly legalized states. I believe that on the backend of the pandemic, more people will venture to casinos and racetracks, driving PENN’s core business as well. Therefore, PENN can also be viewed as a reopening play along with its sportsbook catalyst.

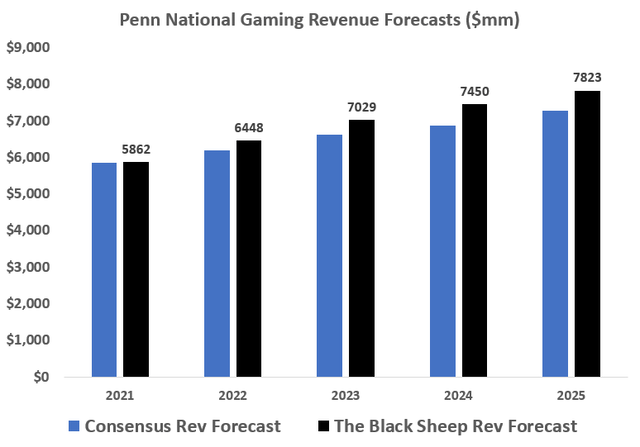

I predict full year 2021 revenues to be $5,862M, pretty much in-line with consensus. Thereafter, my belief is that revenues will increase at a faster clip than consensus, as shown in the chart below.

Consensus Revenue vs Author’s Revenue Forecast (Bloomberg / Author’s Own Estimates)

Consensus Revenue vs Author’s Revenue Forecast (Bloomberg / Author’s Own Estimates)

Increased reach from Barstool’s brand strength, foot traffic improving at casinos and racetracks on the backend of the pandemic, and continued launches in the company’s sportsbook initiative should all drive revenues higher.

I also anticipate higher margins on these revenues of ~10% due to PENN’s acquisition of theScore, which is expected to be accretive to EBITDA in FY2023 and increase margins by eliminating the need to pay third-party technology and service providers. Given these assumptions, I present my free cash flow estimates and DCF model below.

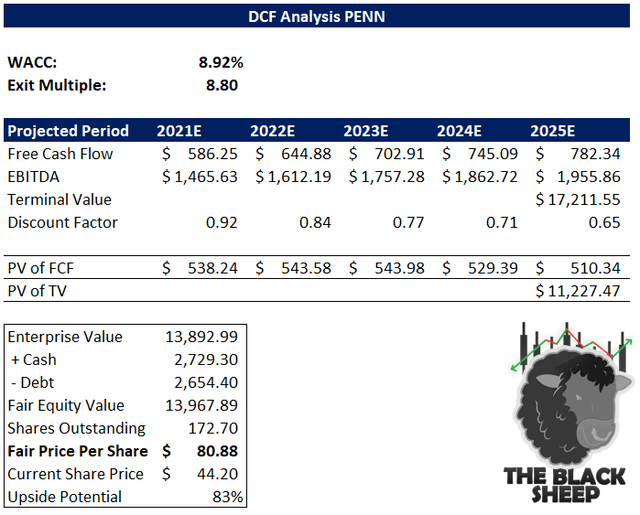

DCF PENN (DCF Created By Author Using Own Assumptions)

DCF PENN (DCF Created By Author Using Own Assumptions)

I assume an 8.92% WACC and a conservative 8.80 exit multiple (26% below PENN’s TTM EV/EBITDA), to derive the final DCF calculation. You can find EBITDA growth and FCF generation estimates in the model as well.

In PENN’s Q3-21 earnings call, management cited several healthy metrics on its balance sheet. PENN ended Q3-21 with $2.73B of cash (up 22.8% Q/Q) along with an undrawn credit revolver of $3.4B. This gives PENN $6.1B of purchasing power for continued strategic acquisition or the ability to reinvest in growth through capex. This cash reserve will slowly improve due to PENN’s strong free cash flow metrics as well. PENN’s current ratio of 3 shows its strong liquidity and ability to meet its short-term financial obligations. The company only has $2.65B of long-term debt and of this debt, a slim 3.6% ($95M) was current in Q3-21. These financial metrics are overwhelmingly positive and support the bullish thesis.

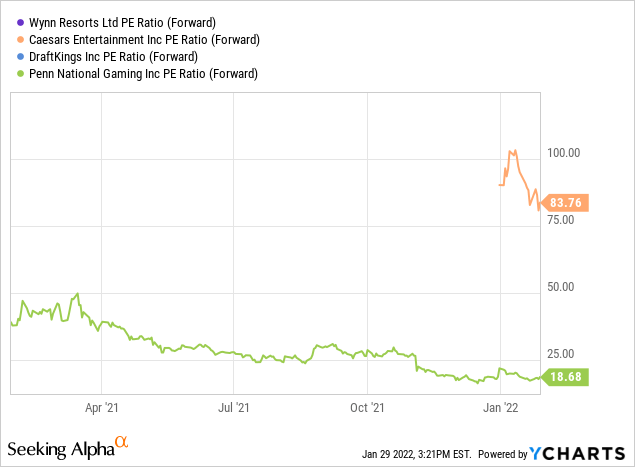

PENN’s main competitors include Wynn Resorts (NASDAQ:WYNN), Caesars Entertainment, and DraftKings. While they directly compete with PENN for market share, none have been able to turn a profit in the midst of the COVID-19 pandemic. This is positive for PENN as the company outmatches its competition on both profitability and free cash flow generation (mentioned above). This also increases PENN’s balance sheet health as the company does not need to issue as much debt to finance its operations. Instead, it has flexibility with its cash to either 1: instate a dividend, 2: begin repurchasing shares, or 3: increase CapEx to reinvest in future growth. I believe PENN will most likely choose option 3 as it capitalizes on recent legalization in sports betting and future launches of its sportsbook. PENN is also trading at a steep discount to its competitors.

As you can see, PENN and Caesars are the only two companies within this sports betting cohort that are expected to generate earnings in the next 12 months. PENN is also much cheaper on a forward earnings basis than Caesars, trading at just 18.68x forward earnings. This is cheap for a company that has shown resilience, continues to generate free cash flow, and has a long runway for growth in the coming years.

The main risk to my valuation would be tax hikes on sports betting winnings. This would cut into PENN’s net income margin and therefore change our overall thesis on the company. Any future COVID-19 variants could also hurt the growth trajectory of the company as it is difficult for casinos to weather the downside effects of increased lockdowns. Although I do not anticipate either of these risks occurring, it is important to shed light on their potential so investors are aware moving forward.

If you believe in the future of sports betting in the US as I and many others do, PENN is a relatively safe way to capture upside. This is due to the company’s strong operating metrics, sound balance sheet, the increased adoption of online sports betting nationwide, and cheap valuation. This leads me to assert a «strong buy» opinion on shares. Investors should use this recent pullback in the stock as an opportunity to accumulate shares at a low price relative to my forecasted intrinsic valuation of the company.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.