Ethan Miller/Getty Images News

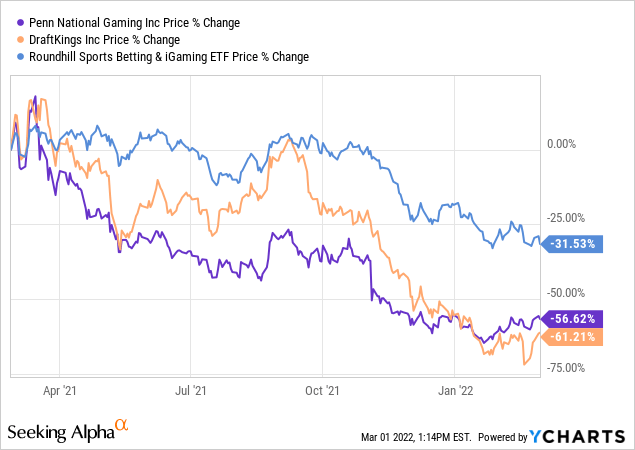

The chart of Penn National Gaming, Inc. (PENN) stock seems to tell a simple story. Investors were euphoric toward sports betting stocks in the second half of 2020 and the first half of 2021, but results in that space (including from Penn itself) have disappointed. And so PENN has dropped 60%-plus from its highs, dragged down by dramatically lower expectations for its Barstool sports betting and online casino business:

After all, Penn’s online sports business is lagging in the U.S., as shown by this Tweet from Chris Krejcik of the respected Eilers & Krejcik industry research firm:

So there’s a way to see the decline in PENN as wholly merited, with the run to $120-plus driven by retail investors and/or Barstool fans, and the fall since caused by Barstool’s lack of success in the market to date. Looking forward, at least in the near-term, geopolitical concerns, higher interest rates and higher gas prices (historically a legitimate headwind for land-based operators) all pose risks. And to top it off, while PENN has fallen from the highs, it’s still gained nearly 100% since it agreed to acquire 36% of Barstool Sports back in January of 2020.

That story, however, misses a potential opportunity, for three key reasons. First, it underestimates the value of Penn’s existing land-based operations, which continue to execute exceptionally well. Second, the interactive business here actually seems in far better shape than simple market share figures would suggest. Third, Penn has plenty of options going forward to adapt to a quickly changing (and normalizing) online gambling world, and to augment its impressive land-based portfolio.

Given those factors, and solid fundamentals, it does seem like from a long-term perspective PENN has sold off too much. Yet short- and mid-term risks are quite high at the moment. Geopolitical concerns, inflation, and higher interest rates all pose potential stumbling blocks, and add to more structural questions about profit margins in the land-based operations. More broadly and more simply, PENN is a leveraged cyclical at a time when market and macro concerns simply have to be at the forefront of investment decisions.

As a result, it does seem like some patience is warranted here. Long-term, PENN probably is a solid pick. Short-term, it’s not hard to believe a better price might come around.

In May of last year, I argued that PENN stock was a solid buy for online gambling bulls – but raised some concerns in terms of valuation. Notably, PENN didn’t look cheap, at nearly 13x 2019 Adjusted EBITDAR. (EBITDAR is earnings before interest, taxes, depreciation, amortization and rental expense for properties leased from landlord Gaming and Leisure Properties (GLPI). That rental expense can then be capitalized and added to enterprise value to properly calculate EV/EBITDAR.)

But with the share price roughly one-third lower, and profits growing, the fundamentals do look relatively stronger. Based on the midpoint of 2022 guidance, EV/EBITDAR sits at 9.25x. But even that multiple is a bit inflated. On the fourth quarter conference call, Penn management projected ~$50 million in losses in the Interactive segment (losses driven by investments in online sports betting and online casino) this year. Back those losses out, and the multiple drops to 9x.

Of course, that 9x figure doesn’t include any value for the online gambling business. Assign, say, $3 billion of value there (more on this valuation later) and the multiple assigned the land-based business drops to ~7.5x. More specific guidance disclosed on the Q4 conference call suggests PENN is trading at ~10x 2022 free cash flow, excluding Interactive losses, working capital changes and growth capex.

Neither multiple is perhaps quite as attractive as it might appear at first. Owing to leverage (Penn’s net debt, including capitalized lease expense, is still more than 4x 2021 EBITDA) and cyclicality, casino operators generally see multiples in this range. PENN itself traded at ~6x EBITDAR and ~7-8x P/FCF only a couple of years ago.

Still, PENN is also far less leveraged than it was then: the 4.1x lease-adjusted leverage ratio at year-end 2021 was the company’s lowest since the GLPI spin-off. And at the very least, PENN at $49 is not pricing in consistent – and importantly, secular – growth going forward, as it was at $100-plus. Valuation here at worst is far more reasonable, even if that valuation isn’t quite as compelling as it would seem relative to the market.

Those reasonable multiples also are assigned to a land-based business that’s growing earnings at a solid clip:

Penn National Gaming, 2022E vs 2021A and 2019A

* – based on company guidance for 2022 given with Q4 results

** – author estimate, assumes zero same-store land-based growth, as roughly estimated on Q4 call

But the comparison of 2019 to 2022 also highlights the biggest question concerning the land-based business. Penn projects that it will grow Adjusted EBITDAR at a ~7% annualized clip over the three years – an impressive performance given still-lingering effects of the novel coronavirus pandemic here in early 2022. As management noted on the Q4 call, it seems like older customers have been the most wary of returning to casinos, and those generally slot-focused patrons usually offer the best margins.

That said, the performance is being driven mostly by profit margin expansion. Penn expects property-level margins of 37% in 2022, which per the Q4 call implies a roughly 500 basis-point expansion from 2019 levels.

That is an enormous move. And the concern for not just Penn, but the industry is whether that expansion is sustainable. Obviously, some patrons in recent years have used federal stimulus money for gambling (if not directly, then indirectly); we’ve seen precisely that activity in the equity markets. (See, for instance, the explosion in option volume at brokerage Robinhood (HOOD).) The operating leverage in the casino model means that incrementally higher spend per visit generally drops almost purely to the bottom line, thus boosting margins. (There’s essentially zero cost difference in serving a blackjack player betting $15 a hand versus one betting $25.)

The promotional environment remains benign as well, as Penn management detailed on the Q4 call. (Caesars Entertainment (CZR) chief executive officer Tom Reeg, on his company’s call, similar said his company saw «nothing to call out» in terms of customer offers.)

The worry here, then, is that 2022 guidance implies something close to peak margins. Regional operators have been pulling back on promotions for roughly a decade now – and margins across the space have expanded as a result. The U.S. consumer remains flush and willing to spend. Go back to 2014, the first full year after the spin-off, and Penn generated consolidated Adjusted EBITDAR margins of 27.3%. 2022 guidance, excluding Interactive losses, suggests a 400 bps expansion. Scale from the Pinnacle acquisition certainly has helped, but it does seem at the very least like incremental margin expansion is going to be difficult from here.

Now, to be fair, those worries have been around for a while. And I’ll personally admit I’ve missed out on gains in the sector due to concerns about margins and valuation both being overblown before the iGaming-driven roller coaster in the space. But those risks do at least keep the valuation assigned the land-based businesses from seeming necessarily compelling right now.

Of course, there are external risks as well. Broadly speaking, even with valuation low and leverage reduced, PENN still has significant macro exposure. Owning PENN right now still means owning a leveraged cyclical at a time when geopolitical and economic risks are high. The economy can turn south. Soaring gasoline prices offer a real risk (spiking prices in the middle of the last decade had an impact on casino visitation, at least according to executives at the time; Penn itself called out lower fuel prices in 2015 as a tailwind to the business).

This is hardly a hidden risk – but that’s the point. At a time when the equity market clearly is jittery, there are real questions about owning any leveraged cyclical right now. Indeed, PENN declined nearly 5% on Thursday. (Disappointing earnings from Rush Street Interactive (RSI) admittedly may be a factor.)

At the same time, it’s difficult to see an obvious catalyst in the near term. First quarter earnings in late April or early May are unlikely to change the story much on either side of the business. Penn has some room for M&A (more on this in a bit), but this is typically not the environment for a transformative deal, whether from the perspective of buyers or sellers.

There’s one more issue relative to the risks here: there may well be better options for buying a risky stock well off its highs. Many of the formerly-popular growth names in other sectors (electric vehicles, SaaS, etc.) that have plunged no doubt have higher risk, because some of those names will go to zero. But even within the space, Wall Street analysts see higher upside in CZR and DraftKings (DKNG), among other names.

There is a lot to like with PENN stock, certainly. But investors need to mind the risks, whether in terms of longer-term margins, the mid-term macro cycle, or short-term trading.

Even with all that negativity, however, there is an attractive story underneath. It may be difficult to continue margin expansion going forward, but particularly given consolidation over the past few years (Penn-Pinnacle, Eldorado-Caesars, etc.) a return to an overly promotional environment seems unlikely. Macro risks are real, and PENN no doubt underperforms in a bear market, but those risks exist across the market. A resolution of the crisis in Ukraine would be wonderful for reasons far beyond the performance of U.S. stocks, but such a resolution could spike equities, with PENN in that case likely to outperform.

And, again, as far as the land-based business goes, the story is at worst solid. This is a company that has executed well, grown nicely, and expanded margins. Valuation is in line. Meanwhile, there is a case that the online gambling business actually is performing much better than simple market share figures would suggest, and that PENN has been an unwarranted victim of the sell-off in the space.

After all, Penn National by design did not follow the strategy of DraftKings, Caesars, and (to a lesser extent) MGM Resorts International (MGM) and Flutter Entertainment (OTCPK:PDYPY) unit FanDuel. Those operators flooded the market with advertising and promotions (most notably DraftKings to begin and William Hill in the second half of 2021). Penn, instead, acquired its Barstool stake and looked to use that brand and its existing fanbase to grow at a slower, steadier and far less expensive rate.

That strategy actually is working:

Penn National Gaming, Inc. Q4 earnings presentation

Penn National Gaming, Inc. Q4 earnings presentation

Penn’s Interactive business has gained market share and moved toward profitability (management projected the business would move into the black next year, with one analyst modeling $85 million of EBITDA) without the ridiculous spending from peers.

The good news for Penn and Barstool is that the environment now is going to change dramatically. Caesars is going to «dramatically curtail its media spend immediately,» as Reeg said after Q4. In Virginia, where I gamble on occasion, promotions across sites clearly have been reduced materially, with Caesars making the most obvious changes. (During Q3 and Q4, there were many days when the expected value of Caesars offers, including the potential for winning $1000 in free bets on NFL Sundays, exceeded that of the other 8-10 operators in the state combined.)

So in an environment where competitors were buying revenue at unsustainable levels, Penn and Barstool still took sports betting share nationally, and grew the iCasino business in key markets Michigan and Pennsylvania. With the competitive playing field now much more level, the company’s same strengths still should hold. That seems to leave Penn’s online gambling business in tremendous shape going forward.

On its own, I’m not sure that’s quite enough to buy Penn National stock. This still is a company with a lease-adjusted enterprise value above $17 billion. I’m loath to see Barstool sportsbook/casino accounting for anywhere close to half that, given that DraftKings has an enterprise value of ~$16 billion and in the range of four times greater market share.

But Barstool certainly is material to valuation. A $5 billion figure assumes a 2022 price-to-revenue multiple in line with DraftKings, and ~60x 2023 EBITDA with years of growth ahead (if only from continued state openings). There’s certainly a healthy debate about the precise valuation for the interactive businesses here, but $5 billion seems directionally reasonable.

That in turn sets up the greedy generalist/value case for PENN stock: getting the online gambling business for free, or something close. At $49, with the land-based business valued at ~9x EBITDAR, we’re probably not quite there yet, given margin and cyclical risks to 2022 expected profits and cash flow.

That said, we’re not that far, either. In the $40 range, that case becomes much stronger, with a margin of safety that covers both further compression of the online gambling visitation (notably if new U.S. states provide less-attractive tax regimes, or if the entrance to Canada via the acquisition of theScore disappoints amid competition from European rivals like bet365 or Entain’s (OTCPK:GMVHY) bwin) and risks to profits and margins in the legacy business. It doesn’t seem a pure coincidence that PENN bottomed essentially at $40 in January.

$49 is a good price for PENN stock, particularly for investors willing to take on macro risks or who are more bullish on U.S. online gambling stocks. $40 would be a great price for almost any investor. Given everything that’s going on, it does seem at least possible that price is on offer again, and the story underlying PENN means waiting for that price could and should be a profitable trade.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.