PonyWang/E+ via Getty Images

2021 was brutal for China’s tech stocks. Some smaller cap stocks such as HUYA, DOYU and TME lost as much as 88% of their market cap. Alibaba (NYSE:BABA) got hammered -47%. And other companies such as Baidu (NASDAQ:BIDU) managed to sneak away with acceptable losses of only -24%.

Y-Chart.com

Y-Chart.com

Two big tech players, however, held up pretty well — with percentage losses only in the single digits. Notably, these companies are JD.com (NASDAQ:JD) and NetEase (NASDAQ:NTES). This naturally raised my curiosity and I was eager to take a close look at the businesses. I wrote about JD.com here (spoiler: it is a great company) .

In the following article I will focus on NetEase. First, I will present a company overview. Second, I will present a financial overview. And finally, I will apply a DCF valuation to calculate the intrinsic value of NetEase depending on a base-, bear- and bull-case scenario.

For those of you who do not want to read all the «analysis», but only a concise and precise summary of my research, here you go: I initiate my coverage on NetEase with a buy recommendation and a target price of $215 till 2025, implying a CAGR of 20.1%.

NetEase is a leading internet company in China, focused mainly on gaming, but has also expanded into various services centered around innovative content, community, communication and commerce.

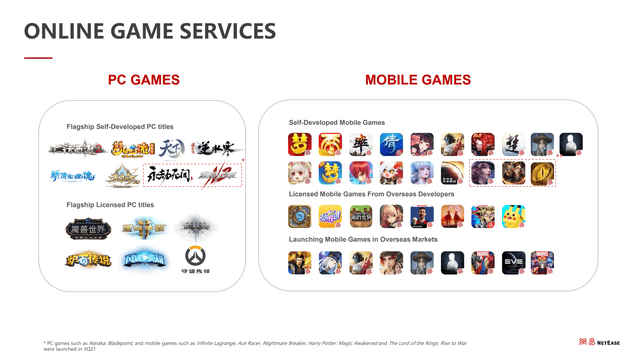

As a leading gaming company, NetEase develops and operates some of China’s most popular mobile and PC games. So far, the company has more than 100 games in operation. In addition to its self-developed game content, NetEase partners with other leading game developers, such as Blizzard Entertainment and Mojang AB (a Microsoft subsidiary), to operate globally successful games in China. Notably, NetEase itself has made major breakthroughs in international markets including North America and Japan. In 2018, «Knives Out» occupied the first place for 6 months in the ranking of China’s overseas mobile games. At the same time, NetEase Games has successfully launched many additional popular titles internationally including Rules of Survival, Identity V, Onmyoji, Onmyoji Arena, Life After.

NetEase Investor Presentation

NetEase Investor Presentation

NetEase is ranked as the #2 of the world’s largest game developers, only behind Tencent. And we all know, the gaming industry is on fire. Whether it be the future of entertainment, VR/AR, the Metaverse, NFTs, or another tech trend: the gaming industry will likely be the battleground of the tech giants to realize innovation and seek growth. Looking into the future, in my opinion, NetEase is well-positioned to capture the game premiumization trend with a strong product portfolio, creative ingenuity and international expansion.

However, gaming is not the only business of NetEase. In fact, NetEase has expanded into a diverse basket of internet services and business models. Arguably the most important ventures are:

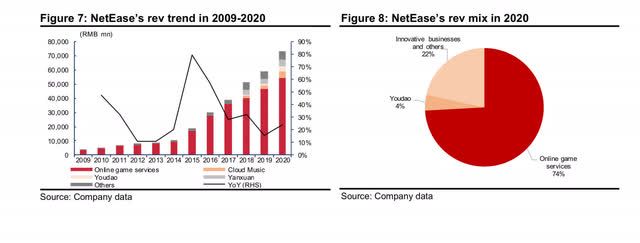

The following graph gives an overview on how the revenue share of the various businesses is allocated. As you see, ‘online game services’ are by far the largest component with 74%, followed by ‘innovative businesses and others’ with 22%, and Youdao with 4%. Notably, since approximately 2017, the non-gaming businesses started to accelerate and account for a bigger and bigger share of revenue growth. As management noted in various analyst calls, this trend is likely to continue.

CMBIS Research

CMBIS Research

When evaluating the financial potential of a company, I like to see three key features: Revenue growth, strong operating cash flows, and a healthy balance sheet. While the overall conclusion is relatively favorable for NetEase, the financial numbers do not necessarily imply a undervaluation in reflection of the current market capitalization.

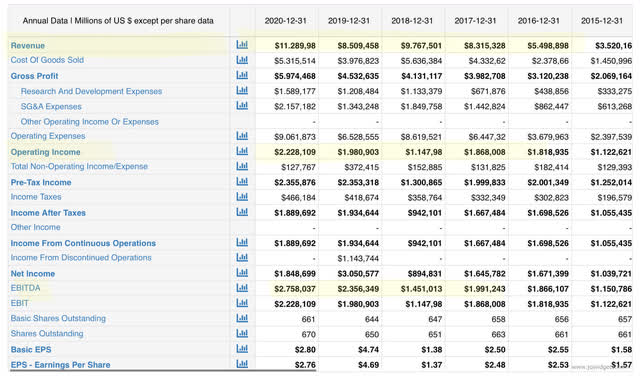

First, let us start with the income statement. In the period 2018 until 2020, revenues grew from $8.3 billion to $11.3 billion, implying a compounded annual growth rate of 8.02%. In addition, growth in operating income kept perfect pace and grew from $2.0 billion to $2.8 billion. Notably, NetEase cyclically adjusted EBITDA margin stands at approximately 24.4%.

MacroTrends, NetEase Financial Data

MacroTrends, NetEase Financial Data

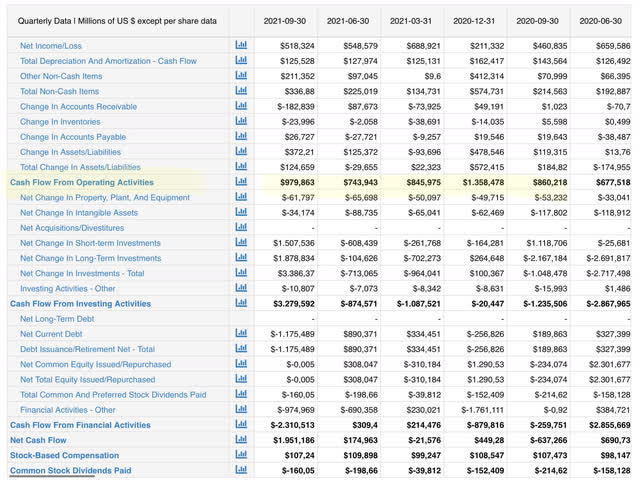

The cash flow statement partially confirms what we have seen in the income statement — an effective business. As you may note, cash flow from operations is consistently lower than net income levels, calculating a cyclically adjusted average of 930 million per year. Honestly, I don’t like this observation, because a operating result lower than net-income usually implies low-quality earnings.

For reference, NTES market capitalization, as of early February 2021, stands at only $69.5 billion.

MacroTrends, NetEase Financial Data

MacroTrends, NetEase Financial Data

NetEase’s balance sheet appears strong and healthy. As of early 2022, NetEase records $14.7 billion of cash, which is approximately 21% of the company’s market capitalization. In addition, total debt levels at only $9.7 billion imply a leverage ratio of less than 1/2. Thus, in my opinion, NTES could absorb some multi-year headwinds, while also making considerable investments in long-term growth opportunities and new product developments.

Finally, I would like to highlight that almost no intangible assets are recorded on the balance sheet, despite this category probably being the most important asset — and of the highest monetary value.

MacroTrends, NetEase Financial Data

MacroTrends, NetEase Financial Data

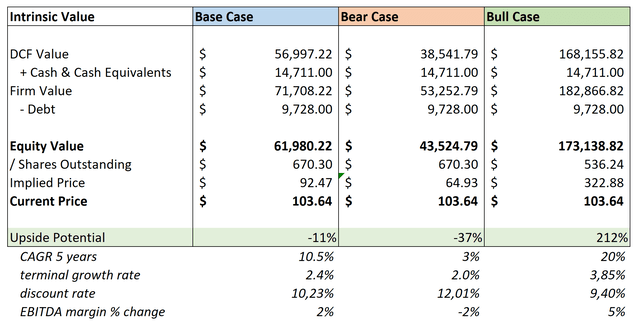

Let us now look at what could be a reasonable price target for the company. I have constructed a DCF valuation with a sensitivity analysis of key assumptions. The results of my analysis are termed Base-, Bear-, and Bull Case. (Some assumptions for the analysis are listed under the respective case).

Author’s Calculations

Author’s Calculations

As you see, possible valuations for NTES, given the current knowledge about the company, could be between 64.93 US$ per share and 322.88 US$ per share. I would like to note, however, that the probability weighting of these targets are not normal distributed! On the contrary, I expect the probabilities are slightly skewed towards the bull-case. I personally estimate the following probability distribution. Feel free to challenge my personal assumption.

I base my argument for the bull-case on NetEase’s excellent track record of successful business development and new-venture incubation, paired with my favorable outlook on the future of the Chinese economy and the international gaming industry. I personally expect a valuation of approximately $215 per share by the end of 2023.

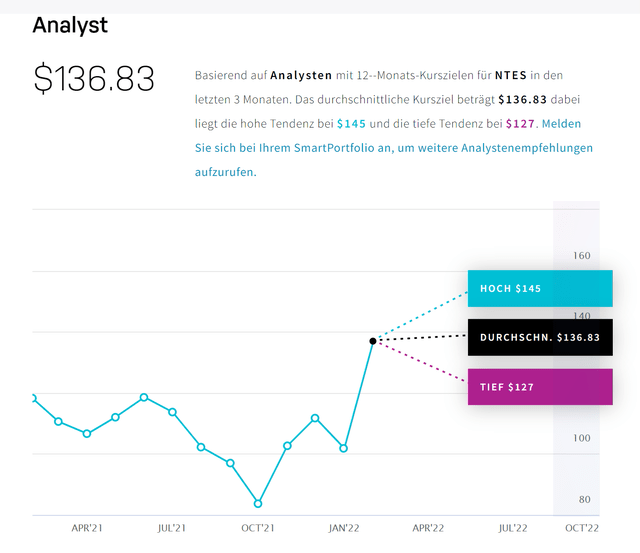

However, to give a more balanced valuation on NTES, let us look where other analysts set their price-target. As you see, the mean is calculated at $136.83 per share — also reflecting a slightly bullish bias.

Nasdaq.com

Nasdaq.com

Although the market has probably priced in too much negativity for Chinese stocks in general, NetEase has largely been unaffected by the impact of regulatory headwinds and political uncertainty. This doesn’t mean, however, that NetEase has some kind of permanent ‘immunity’.

Regulatory Headwinds in China. Perhaps the main risk for the NetEase stock is continued pressure coming from the Chinese government. I don’t want to politicize the discussion or present myself as an expert on China, which is why I would like to encourage every investor to research and assess the situation by himself.

ADR Delisting Fears. This risk is closely tied to the previous concern of regulatory headwinds. I personally am not afraid of an ADR delisting, but the negative market sentiment and fear could definitely keep the stock price depressed for some time. Notably, NetEase is also listed on the Hong Kong Stock Exchange.

The gaming industry in China is not without competition. In fact, the gaming industry in China is so popular and financially attractive that it has attracted many players. The biggest competitor is obviously Tencent (OTCPK:TCEHY). But, of course, also international players such as Activision Blizzard (NASDAQ:ATVI), Take Two Interactive (NASDAQ:TTWO) etc. must be evaluated when analyzing the industry.

NetEase is definitely an interesting tech company. And being a leader in the gaming industry, I expect NetEase will benefit from a secular growth narrative that will cause NetEase industry to greatly outperform the broad economy. Gaming, for me, will be the battleground of the tech companies in the next few decades.

From a fundamental perspective, however, I am not fully convinced. While NetEase definitely appears like a good business and attractive investment overall, I personally believe the Chinese market has equally great businesses at cheaper valuations — making special reference to Baidu (BIDU).

Concluding with numbers: I expect a target price of $215 till 2025, implying a CAGR of 20.1%.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: not financial advise