Maskot/DigitalVision via Getty Images

By Hilary Frisch, CFA

Maskot/DigitalVision via Getty Images

Video games are becoming one of the leading recreational activities globally. Unlike most other entertainment content, video games create a social and interactive experience that offer gamers a chance to compete and to cultivate their creativity. While the $180 billion industry has long been associated with young, male console owners, developments in the accessibility and nature of gaming has created a community that spans genders, income levels, ages and geographies. These developments have created a race among technology companies to acquire video game publishers and platforms. Earlier this year Sony (SONY) stated its intention to purchase game developer Bungie for an estimated $3.6 billion, Take-Two Interactive (TTWO) agreed to acquire mobile gaming company Zynga (ZNGA) in a transaction valued at approximately $12.7 billion and Microsoft (MSFT) announced its largest acquisition ever for Call of Duty (CoD) maker Activision Blizzard (ATVI) for $69 billion.

Heightened deal activity reflects a wider shift in perception of the video game business by media and technology companies. Microsoft and Sony have recognized that the benefits of acquiring video game platforms and publishers extend beyond the revenues from an individual game title. Through such acquisitions they are endeavoring to create their own gaming ecosystems — virtual destinations where gamers can download and play games as well as access digital and streaming content to create a closed-loop digital entertainment destination.

Innovations in mobile gaming, content development and connectivity are widening the total addressable market for gaming. One of the greatest catalysts for the growth of video games has been mobile gaming. The ability to extend gaming’s reach beyond the console has helped to accelerate the proliferation of gaming and engage demographics that previously would not consider themselves gamers. Additionally, the relatively low barriers to entry for the development of mobile games versus console games have helped mobile developers publish a wider range of games to attract and retain a greater audience. This has caused an explosion in the popularity of mobile games, which now make up over 50% of total video game industry revenues and total approximately $93 billion.

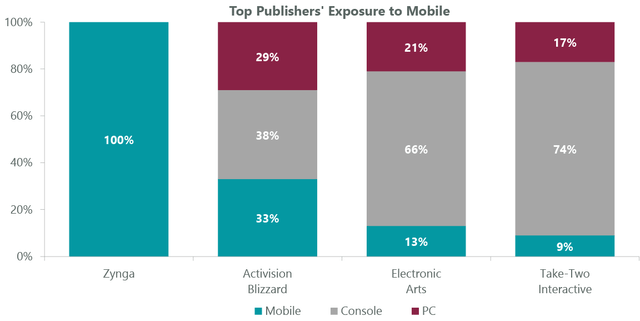

The development of games specifically for mobile such as the widely popular Candy Crush or Fruit Ninja have garnered attention, and larger, well-established console-based franchises are taking note (Exhibit 1). The release of Activision Blizzard’s Call of Duty:Mobile in October 2019 was the first foray of a large console franchise into mobile gaming. CoD:Mobile turned out to be a huge success, with nearly 210 million active players and 30 million daily users. More surprisingly, it gained popularity beyond traditional gaming demographics.

Exhibit 1: Mobile Has Major Growth Opportunities

Corporate Filings

Corporate Filings

Content continues to be a critical driver in gamer engagement on all platforms. Demand is so high, in fact, that gaming platforms such as Roblox (RBLX), Unity (U) and AppLovin (APP) have opened their developer toolkits and encouraged users to use their platforms to develop and self-publish their own games and experiences. Since Roblox launched in 2006, its users have created over 40 million games, spawned 9.5 million individual game developers and approximately 202 million monthly active users. With 67% of Roblox users under the age of 16, the chance to make and share their own games has allowed these young developers to create content specifically geared to other pre-teens, generating greater engagement with this age demographic. Additionally, Roblox has achieved a much more balanced split across gender than traditional video games demographics.

Gaming has also become a much more social activity through greater Internet access. No longer limited to the same console or geographic region, gamers are now able to collaborate and compete with other gamers across the globe. Companies have been quick to recognize heightened levels of competition drive gamer engagement and have been actively working to foster greater competition to extend game playability and monetization opportunities.

Video game publishers have also developed new monetization strategies. These include extending the life of their major titles and leveraging their existing fanbases by creating and selling new, downloadable content («DLC») that offers add-ons, including exclusive character skins and levels. Mobile publishers have found new opportunities to increase revenue streams and player communities by developing “freemium” games, which include free-to-play games with the option to purchase premium content or include in-game advertisements. Freemium games not only offer prospective users free content to entice upgrades to premium services, but also create a steady revenue stream using in-game advertisements.

Finally, the shift to mobile gaming and digital downloads has cut costs. While game development has traditionally incurred high up-front costs for the physical production of hardware such as CDs and retail costs of shelf space before a single copy is sold, direct-to-download has reduced or eliminated many of these initial rollout expenses, reducing overall development spending.

While growth and increased monetization of games are viable investment catalysts, tech companies have also recognized that video games are crucial to the development of next-generation digital content.

Heightened competition among gamers has boosted the attraction of esports as a viable entertainment medium. In May 2021, the Free Fire World Series featuring its mobile battle royale game was streamed by over 5.4 million viewers in 18 different languages. Sony has sought to incorporate esports into its PlayStation ecosystem by acquiring the world’s largest fighting game championship tournament, the EVO Championship series, in 2021 and filing a patent for an esports betting platform run through PlayStation. Combined with greater integration of video game streaming services such as Twitch and YouTube with Microsoft, Sony, Amazon (AMZN) and Google’s (GOOG) digital ecosystems, esports should continue to be a significant content driver for major tech companies.

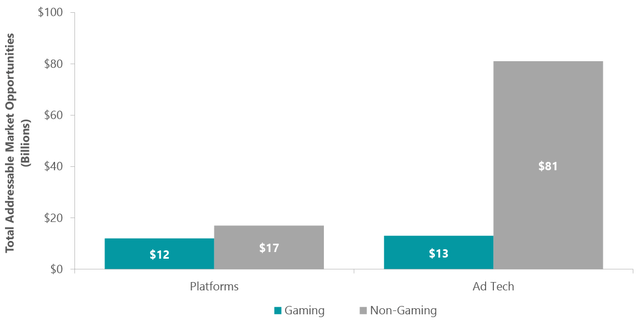

Video games’ role in the burgeoning metaverse offers even greater possibilities. Envisioned as a network of 3D, virtual worlds focused on social engagement, the metaverse offers participants the possibility of nearly endless digital environments in which to work, shop and engage. Gaming platforms such as Roblox already offer users the tools to construct their own games and serve as a microcosm of the larger digital ecosystems that tech companies are jockeying to build. As tech companies look for new ways to maximize their footprint in the metaverse, they will increasingly look to the resources and experience offered by traditional and emerging gaming companies (Exhibit 2).

Exhibit 2: Growth Potential Outside Gaming is Growing

ClearBridge Investments, Unity Software SEC Form S-1 2020 and Applovin Corporation SEC Form S-1 2021.

ClearBridge Investments, Unity Software SEC Form S-1 2020 and Applovin Corporation SEC Form S-1 2021.

Driven by the explosion of mobile gaming and next-gen technologies supporting development of the metaverse, the video game industry offers one of the more attractive secular growth profiles in media and technology.

Hilary Frisch, CFA is Senior Research Analyst for Information Technology at ClearBridge Investments.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SONY, MSFT, U, APP, ATVI, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is no guarantee of future results. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.