Jonathan Knowles/DigitalVision via Getty Images

Jonathan Knowles/DigitalVision via Getty Images

Realty Income (O) has increasingly been dabbling outside of their foundational strength of triple net retail. A while back they moved into Europe and now they are dipping their toes into casinos with the $1.7B purchase of the Encore Boston Harbor.

This purchase is consequential, not just for Realty Income, but for the entire triple net sector. As such we have taken the time to dig into the specifics of the transaction to see how it compares with the field.

In brief, the transaction solidifies our bullishness on VICI Properties (VICI) as O’s stamp of approval is a major step toward valuing the entire gaming sector higher. As of today, VICI trades at a massive discount to O and is, in my opinion, the superior investment.

Our thought process is below.

With triple net purchases, valuation and reliability of cashflows are top of mind. To get a sense for these, here are the vital stats.

This looks rather expensive for a gaming asset on both a cap rate basis and an NAV basis. Following is a list of MGM Growth Properties’ acquisitions and the cap rates ranged from 6.3% to 8.5%.

MGP

MGP

To be fair, gaming cap rates have been trending down with VICI Properties’ recent acquisition of the Venetian for a 6.25% cap rate.

The price per key also looks rather high at $2.53 million per room. Both the Venetian and the entire MGP portfolio were acquired for $0.6 million per room.

VICI

VICI

Note that MGP’s price per key was much cheaper if you include the non-Vegas properties

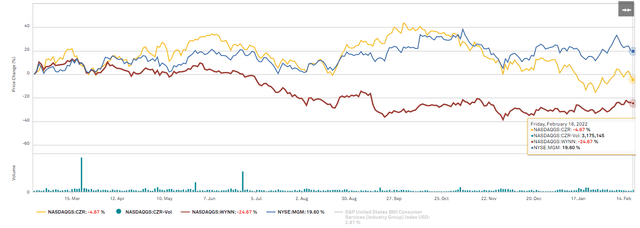

The 2.1X EBITDAR coverage of rent on the Encore is about in line with peers, although I would consider Wynn Resorts (WYNN) to be a substantially weaker tenant than either Caesars (CZR) or MGM Resorts (MGM) which are the main tenants of VICI and MGP, respectively.

SNL Financial

SNL Financial

Macau has been problematic which has pulled WYNN down significantly and creates fundamental risk. The Encore itself is in Boston, so it is not directly susceptible to Macau fundamentals aside from the impact on the parent company’s ability to pay rent.

Gaming licenses are quite limited in Massachusetts making The Encore just about the only game in town aside from the MGM Springfield (owned by MGP and soon VICI).

This provides an excellent ratio of total travel to the area relative to the number of casinos and bodes well for the growth of each of these casinos.

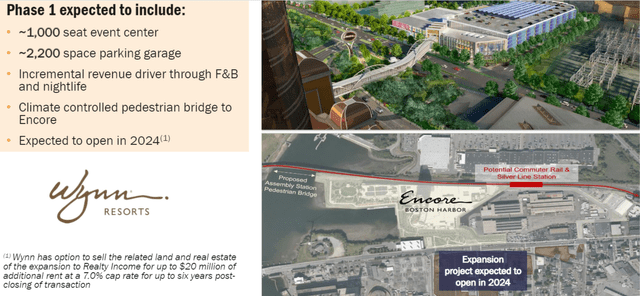

Wynn resorts is planning to expand with a proximal development of the Phase 1 expected to open in 2024.

O

O

This is both good and bad for O.

If successful, it will be another accretive acquisition for O at a pre-negotiated 7% cap rate, but the challenge here is that the sale to O is at Wynn’s option. Thus, it may be forced upon O if unsuccessful or may choose to not sell it to O if it is wildly successful.

That said, I think the most likely outcome is that it does okay and O gets the property given the value of land in this area and Wynn’s capital needs. I think the relationship between O and WYNN is mutually beneficial as Wynn needs capital and O needs acquisitions while having access to vast amounts of capital.

The Encore comes with a 30 year lease with 1.75% escalators for the first 10 years followed by a CPI based floor and ceiling of 1.75%-2.5% for the remainder of the term.

I find this to be a little bit rough in the near term given that inflation is substantially higher than 1.75% and the ceiling of 2.5% in the out years means even the CPI escalator doesn’t really protect against inflation. However, O does have the ability to match fund this with locked in, fixed rate debt so assuming there is no lease default, they can make it accretive regardless of where inflation goes.

While O overpaid for the asset relative to what MGP and VICI paid for their casinos, that doesn’t mean that O overpaid. I think it is far more likely that MGP and VICI drastically underpaid for their assets.

It all comes down to where one thinks the cap rate should be. I have long believed that cap rates on gaming assets have been far too high. It seems almost absurd that they trade wide to generic triple net free standing single tenant retail assets.

If you look in any other property sector trophy properties command a premium valuation (lower cap rate).

So why is it that a Dollar General goes for a 5% cap rate while gorgeous, epic real estate like the casinos that are famous world-wide trades at 6%-9%?

I think casinos have been dramatically undervalued as a result of their nascency in the institutional investment space. The cashflows look quite secure with the sector even paying rent through COVID when they weren’t even allowed to open their doors.

So despite O getting a less great deal than MGP and VICI have been getting, it still looks like a good deal. It will be solidly accretive to O’s FFO/share and a nice diversifier.

O is broadly known as a company that doesn’t take a whole lot of risks. As such, their willingness to take on a massive gaming asset at a 5.9% cap rate resets the cap rate of the entire sector to the now lower level.

I think cap rates were heading south anyway, but O’s imprimatur has likely accelerated the revaluation. In light of this, the gaming pure-play REITs look very attractive.

VICI trades at a 3.3 turn discount to O.

Company

Price to FFO 2022 est

Price to FFO 2023 est

Realty Income

16.8X

16.1X

VICI

13.5X

12.7X

This results in a 7.4% FFO yield on VICI versus a 5.9% FFO yield on O.

I’ll take the trophy assets at a 7.4% cap rate on my investment over the Dollar Generals at a 5.9% cap rate any day of the week.

Given how far market prices have fallen I am moving to neutral on O from my previous bearish stance. It is now trading at roughly fair value. However, given how far the rest of the market has also fallen, I don’t really want to invest at fair value. There are great opportunities right now trading well below fair value and VICI is one of them.

VICI has spent the last few years buying up assets that are now demonstrated to be worth vastly more than VICI paid. That is where I want to be. I currently own VICI through MGP as there is still a slight bit of arbitrage upside in the cheaper MGP shares as we wait for the merger to close.

Make your money work for you

At Portfolio Income Solutions we do the rigorous analysis to determine which stocks will work and which won’t. We then curate a portfolio of the most opportunistic individual stocks and provide members with continuous analysis to help keep their investments in shape. We constantly watch the market in order to buy and sell the right stocks at the right times.

Start investing with the aid of dedicated research by joining Portfolio Income Solutions.

Not sure yet? Grab a free trial. Canceling is easy and there are no obligations.

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation. I am an investment advisory representative of 2nd Market Capital Advisory Corporation, a Wisconsin registered investment advisor, along with fellow SA contributors Simon Bowler and Ross Bowler.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Disclosure: I/we have a beneficial long position in the shares of MGP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.