Returns as of 02/19/2022

Returns as of 02/19/2022

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Motley Fool Issues Rare “All In” Buy Alert

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Semiconductor giant Nvidia ( NVDA -3.53% ) has been quickly growing its business and the stock has been flying. Shares more than doubled in 2021 and have more than tripled over the last two years.

But more recently, investors have been taking profits, and that accelerated after the company reported earnings this week. But a deeper look at the data and the story shows that Nvidia is far more than a gaming company now, and its growth is more profitable than some investors may have thought.

Image source: Nvidia.

Nvidia increased total revenue 61% in its 2022 fiscal year ended Jan. 30, 2022, versus the prior year period. It sees that growth continuing into fiscal 2023, and not just from its gaming segment. While gaming has been what Nvidia chips were best known for, it has moved into other segments that are already contributing. Data centers are close to overtaking gaming as the largest contributor to total revenue.

Data source: Nvidia. Chart by author.

And the company is working with automakers that will use its autonomous vehicle and driver assistance computing platforms. Most recently, it announced a partnership with Tata Motors‘ Jaguar Land Rover Automotive. Nvidia CEO Jensen Huang said in the company’s earnings conference call that «Starting in 2025, all new Jaguar and Land Rover vehicles will have next-generation automated driving systems, plus AI-enabled software and services built on the Nvidia DRIVE platform.»

Even with the promising business update, Nvidia shares dropped after its earnings report. One aspect to that move was the huge move up the shares have already made over the past two years. Investors may also have been spooked when the company predicted gross margin would remain flat in the current quarter. But as the chart below shows, the company has already shown it can grow revenue faster than expenses, and therefore increase profitability.

Data Source: S&P Global Market Intelligence. Chart by author. Dollars in millions.

A year-over-year drop in auto revenue also may have concerned investors. But in addition to the Jaguar and Land Rover deal, and a previously announced deal with Daimler‘s Mercedes-Benz, Nvidia’s DRIVE computing platform will be used by Chinese electric vehicle makers Nio and XPeng for their upcoming vehicle launches.

CEO Huang also believes the company’s visualization segment will be a big part of its future. On the conference call, he explained the company is targeting «creators contributing content to a virtual world and connect it to robots that are contributing to content in a virtual world.» Huang pointed out that the amount of robots being used will number in the hundreds of millions.

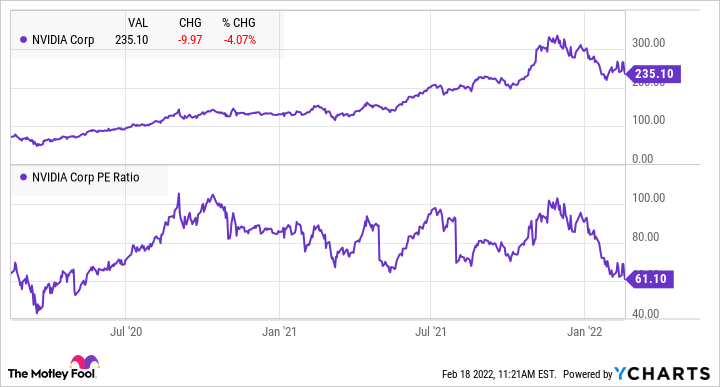

While some investors decided to take profits after this earnings period, there remains much to be excited about for Nvidia’s future. The stock’s drop, along with strong earnings, has brought the price-to-earnings (P/E) ratio to a two-year low.

NVDA data by YCharts

While a P/E of 60 is still expensive, if the company continues to grow at the current pace, or faster, the valuation won’t look overly high for much longer.

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool’s premium services.

Making the world smarter, happier, and richer.

Market data powered by Xignite.