Jean-Luc Ichard/iStock Editorial via Getty Images

Jean-Luc Ichard/iStock Editorial via Getty Images

For decades, Microsoft Corporation (MSFT) has been a household name through its Windows operating systems and Flagship gaming console «Xbox.» The company has been swiftly moving into the gaming arena and has pioneered leveraging gaming with its «Game Pass» subscription model. With the recent acquisition of Activision, the company may just be planning its biggest move into the Metaverse. I am bullish on the stock because of its continuous forward-looking and long-term strategic moves to create shareholder value and wealth, especially relating to the gaming industry, the Metaverse, and Cloud Computing.

Microsoft’s acquisition of Activision (NASDAQ:ATVI) has become an online trending subject, creating a buzz around the company’s ambitions in the Gaming market. The deal, which is expected to close in the second half of 2023, will not only be Microsoft’s but the gaming industry’s biggest all-cash acquisition transaction yet, standing at around $69 billion in enterprise value and $95 per share, dwarfing its previous biggest acquisition, LinkedIn, which stood at about $26 billion.

Obviously, on a relative scale, the acquisition only accounts for 3.3% of Microsoft’s total market capitalization of $2.14 trillion, and some may argue that it is insignificant. However, MSFT is already a major player in the gaming sector, and the addition of Activision creates synergies that offer greater operational efficiencies and strategic competitive advantage to capitalize on the untapped metaverse market.

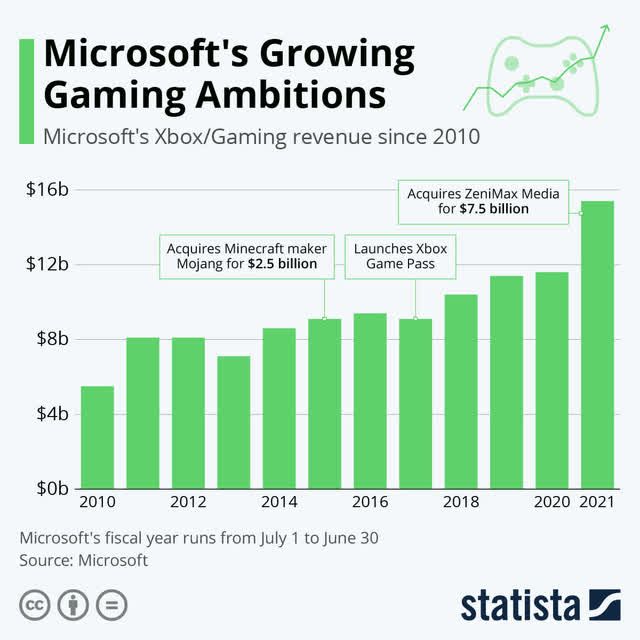

This acquisition highlights the company’s serious ambition into the gaming market. It has consistently grown its market share into the gaming segment throughout the previous two decades since the launch of Xbox in 2001. In addition, the company has aggressively expanded its gaming endeavor since the acquisition of Mojang, the creator of Minecraft, in 2015. This was followed by the launch of Xbox Game Pass in 2017 and the acquisition of ZeniMax Media, parent to Bethesda Game Studios, last year.

Microsoft’s Growing Gaming Ambitions

Microsoft’s Growing Gaming Ambitions

statista.com

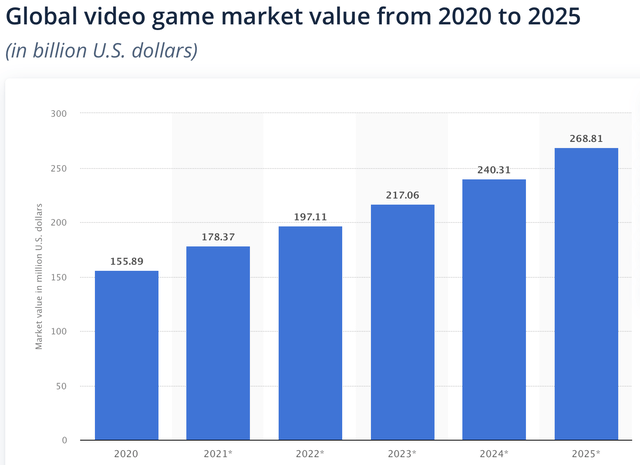

These investments have captured a significant chunk of the almost $180 billion video gaming industry, leading the company’s gaming component to account for almost 11% of total revenue. According to Statista, Microsoft dominates the Gaming Networks market with a whopping 50% market share in the United States. In comparison, Reuters has reported a 10.7% post-Activision-buyout global gaming market share for the tech giant.

Global video game market value from 2020 to 2025

Global video game market value from 2020 to 2025

statista.com

Microsoft’s Game Pass costs $10 or $15 for subscription per month per user, and the company has over 25 million subscribers, translating to an average revenue of $3.75 billion per year. Additionally, mobile gaming hasn’t been one of Microsoft’s strong suits, and Activision’s hold over King/Candy Crush gives the company a strong gateway into that market as well.

With the company’s latest acquisition, Microsoft’s market share and the increasing gaming revenue are poised to grow rapidly with Activision’s additional 400 million-plus monthly active players. This will make ‘the Game Pass one of the most compelling and diverse lineups of gaming content in the industry,’ further solidifying the company’s strong moats.

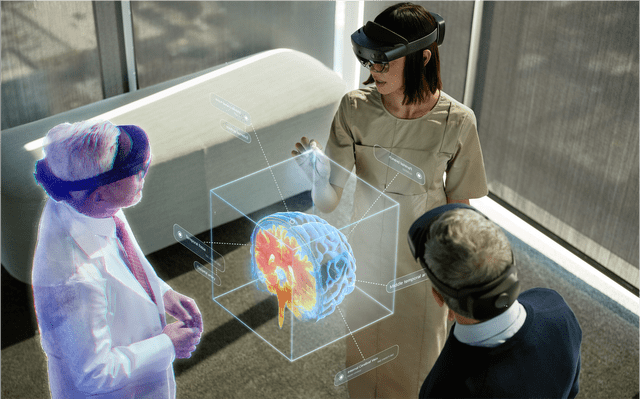

Microsoft’s ‘Mesh’ will be released in the first half of 2022. The Azure-powered software will allow people to connect through the HoloLens 2, mixed reality (MR) headsets, smartphones, tablets, or PCs and collaborate as a holographic presence. The Mesh will leverage Microsoft’s office-based customer base, as it will be integrated with Office 365, to be used as a virtual project sharing space as an extension of Microsoft Teams. Over time, Microsoft plans to incorporate Mesh into its other applications and make Metaverse mainstream. The financial information relating to Mesh hasn’t been made available, so that the precise analysis may be a long shot. Still, the implications of Mesh are expected to resonate throughout the industry.

Quoting Microsoft’s CEO Satya Nadella,

Gaming is the most dynamic and exciting category in entertainment across all platforms today and will play a key role in the development of metaverse platforms.

He said the above in the press release of the company’s Activision acquisition deal which makes it quite apparent that Microsoft plans to leverage Activision’s platform for penetrating the Metaverse. Considering that the concept of Metaverse is still not clearly defined, the frontrunners, including Microsoft, will be the pioneers of what Metaverse transcends into.

The direction and vision of the company is evident, as in an interview with Bloomberg, Satya Nadella said,

If you take ‘Halo’ as a game, it is a metaverse. ‘Minecraft’ is a metaverse, and so is ‘Flight Sim’. In some sense, they’re 2D today, and the question is: ‘Can you now take that to a fully 3D world?’ And we absolutely plan to do so.

Not surprisingly, the collaboration with Activision may do that as the company’s «World of Warcraft» role-playing game also encompasses an extensive virtual world where users appear as avatars and buy virtual goods such as pets, etc.

Microsoft Mesh

Microsoft Mesh

microsoft.com

Investors give credit to the CEO, who, since he took over in 2014, transformed MSFT into a strong cloud player. The azure segment is now a core segment and has delivered strong growth into 2021, with an impressive 32% YoY growth rate. Azure is much more than just a cloud service and leverages AI, BI, and IoT platforms, which are expected to drive growth in the following years.

Microsoft’s Q2-2022 revenue of $51.7 billion and EPS of $2.48 once again beat analyst estimates of $50.88 billion and $2.31, respectively, showing a YoY growth of over 20%. The revenue generated from the company’s cloud computing segment accounted for over 35% of the total revenue at $18.3 billion, with a YoY growth of 26%, outpacing the overall YoY revenue growth. In addition, Azure and other cloud services’ revenue grew by almost 46% in Q2-2022, 50% in Q1-2022, and 51% in Q4 2021. This signifies a prominent growth in the company’s cloud computing business and has been the cause of the post-earnings bull run of the company’s stock.

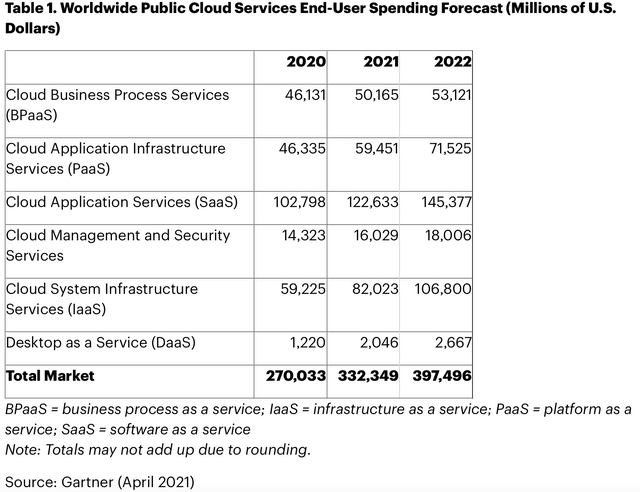

According to Gartner, the global cloud computing market is expected to grow about 19.6%, from $332.2 billion in 2021 to $397.5 billion in 2022. McKinsey reported that the cloud computing market is expected to reach $1 trillion by 2030. This strongly supports the company’s future growth and the favorable cloud outlook for the next decade.

Table 1. Worldwide Public Cloud Services End-User Spending Forecast

Table 1. Worldwide Public Cloud Services End-User Spending Forecast

gartner.com

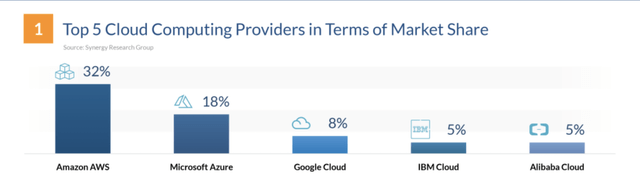

Microsoft Azure is second only to Amazon.com, Inc. (AMZN) Web Services (AWS), with a market share of 18% in the global cloud computing market share. However, it stands to be argued that the numbers don’t really reflect an objective reality since Microsoft performs in many areas of cloud computing that AWS doesn’t, for instance, its SQL segment offers vastly more services which wouldn’t be accounted for in case of a head-to-head market share consensus. Therefore, only comparing the two in areas where both go toe-to-toe doesn’t portray the complete picture. Over ten years, the Azure segment would be the primary growth driver, and as it captures a larger portion of the overall revenue, operating margins are expected to improve slightly.

Cloud Computing Stats

Cloud Computing Stats

s.financesonline.com

Wallstreet analysts retain a positive sentiment regarding the stock with a consensus average target price of $372, an upside of almost 30%. The company’s cloud computing segment plays a major role in these positive sentiments. According to Brent Bracelin, Piper Sandler analyst, Microsoft Azure has already outperformed Windows and is now positioned to overtake Microsoft Office productivity software as the company’s largest source of revenue in 2022.

Similarly, Bank of America’s Analyst Brad Sills wrote that:

Microsoft is well-positioned to generate sustained low double-digit growth in the coming 3-5 years, led by continued adoption of Azure cloud infrastructure platform, cloud-based Office 365 productivity suite and more profitable Games and Game Pass revenue in Xbox.

In the wake of the pandemic, the need for cloud computing has rapidly grown. Microsoft already has a vast customer base composed of corporate clients using its productivity software and data management solutions. As these customers migrate toward the cloud, they would prefer to stick with the same provider rather than shift to a new one. Since Microsoft doesn’t post its Azure dollar figures separately but rather amalgamates it within the total ‘Intelligent Cloud,’ it is hard to predict the exact effect this might have on the financial statements. However, the sentiment stays positive.

The stock market correction has put one of the best tech names on sale, and Microsoft remains one of the strongest players in the tech industry, with far-stretching offerings in multiple arenas. My bullish sentiment around the company resonates from the company’s future intensive initiatives, mainly surrounding the growing gaming market, the upcoming Metaverse, and the accelerated cloud computing market.

Despite being a runner-up in the cloud computing arena, Microsoft Azure’s impressive growth metrics in the recent quarters have highlighted it as a severe threat to the market leader. Moreover, it remains to be seen how the recent acquisition of Activision plays out in the long run, but the overall sentiment regarding the deal remains promising.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.