HJBC/iStock Editorial via Getty Images

HJBC/iStock Editorial via Getty Images

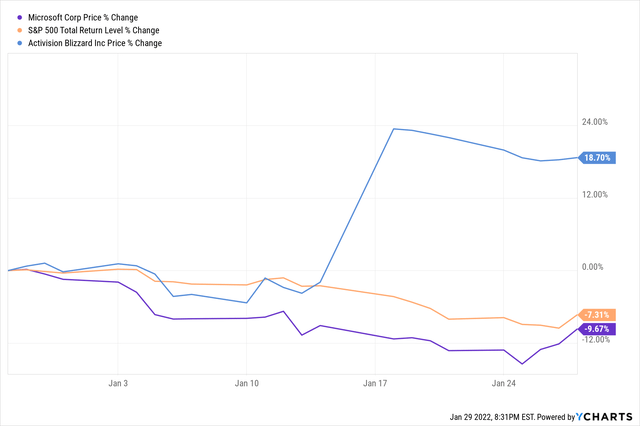

On January 18th Microsoft (MSFT) announced its intent to acquire Activision Blizzard (ATVI) for $68.7B. On the day the announcement was made, shares of Activision soared while shares of Microsoft slouched. Concerns around the valuation paid, and contraction in tech multiples have resulted in a depressed share price.

1 Month Total Return

YCharts

1 Month Total Return

YCharts

Despite the initial negative reaction seen its stock price, Microsoft is a great prospect for investment at these levels. The acquisition of Activision Blizzard is another Nadella masterstroke and makes Microsoft just that much more compelling of an investment.

Microsoft, now known for Halo and its Xbox brand in gaming, had a rough start with regard to their ambitions in gaming.

In the 90’s Bill Gates decided he wanted to carve out a slice of the growing video game market. After approaching, and subsequently, failing to acquire Nintendo (OTCPK:NTDOY) in 1999 Microsoft set out to launch their own console dubbed, the now famous, Xbox.

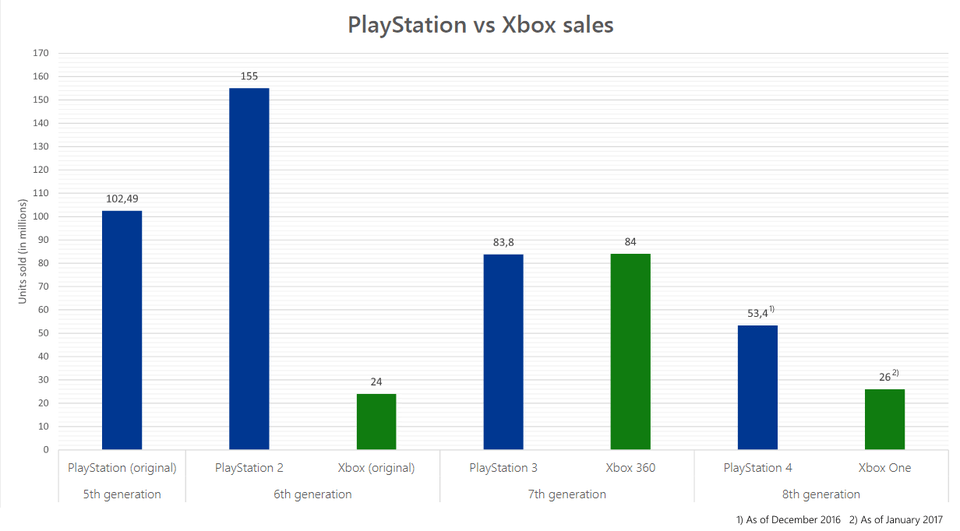

At launch the Xbox struggled to compete with the PlayStation 2 and the Gamecube which ended up dominating the console market space that generation.

Not to accept defeat lying down, Microsoft put together a new way strategy for next-gen with the launch of their Xbox 360. Launching in 2005, this console would focus on online interactive gameplay. The new console quickly became a success; Xbox exclusives like Halo and Gears of War were a massive hit with consumers.

That success was aided by the troubled launch of the PS3 which was overpriced compared to the Xbox 360 and delayed nearly a year. Sony (SONY) all but ceded their dominant position.

Unfortunately for Xbox, they forgot to learn from the mistakes Sony made and got greedy.

In the next generation of console gaming they created the Xbox One and priced it at $499 ($100 more than the Playstation 5). They continued to garner negative sentiment when they proposed complicating the used game market and restricitng lending games to friends. They later reversed that decision but consumers did not forgive that misstep and their sales suffered.

Console Sales By Generation

Author using Data from Wikipedia

Console Sales By Generation

Author using Data from Wikipedia

2020 marked the year we would see the launch of the 9th generation of video game consoles, Sony with their PS5 and Microsoft with their Xbox Series X.

While both consoles sell at the same price of $499 and are, from a technical perspective, nearly identical Xbox and Sony are executing on vastly different business strategies.

Sony continues to bank on the goodwill they gained last generation to drive sales and have have made smaller strategic investments in studios to bolster development of in house IP. In 2020 they acquired Insomniac for $229M, makers of the PS4 exclusive Marvel’s Spider-Man as well as Rachet and Clank.

For the most part Sony has avoided major M&A and has focused on internal development and supporting their PlayStation Plus service. In short, Sony’s strategy appears to be «if ain’t broke don’t fix it».

This strategy has worked well for them so far, but the jury is still out for this new generation.

UPDATE: On January 31st, Sony announced its intent to acquire Bungie, makers of the Destiny series and Halo (Microsoft will keep the Halo IP). The price tag of the transaction appears to be $3.6B, this would be their largest acquisition since the purchase of Columbia pictures in 1989. While large in size, this is still dwarfed compared to what Microsoft has done in recent years.

Xbox, coming into this generation’s consoles launch from a position of weakness, made major changes to its strategy. Eager to make up lost ground given up to Sony, they went back to the drawing board.

Noticing the importance of 1st party content and seeing the success Sony had with Uncharted, God of War, and Spider-Man they crafted a new strategy around IP and changing the way games are sold.

Namely, they have put an extreme focus on building out their gaming subscription service Xbox Game Pass. Attempting to create something along the lines of what Netflix (NFLX) did to the TV business some years ago.

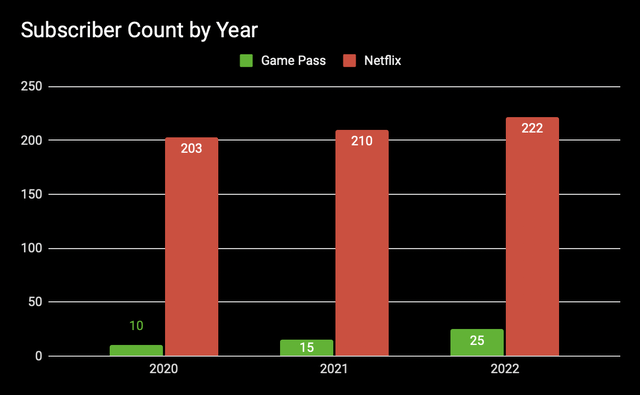

The service is new but growing fast:

Netflix vs Game Pass Subscriber Count By Year

Created By Author Using Data from Earnings Reports

Netflix vs Game Pass Subscriber Count By Year

Created By Author Using Data from Earnings Reports

Game Pass allows anyone who’s willing to pay $15 a month and has access to the internet to stream a wide (and growing) library of AAA and indie games. The Game Pass streaming service has the potential to one day replace the need for a device like Xbox Console.

I elaborated on this concept in greater detail in my first article written on seeking alpha regarding Unity Software, and in my other article covering an industrial IoT provider, but moving to a recurring revenue model can perform wonders for investors.

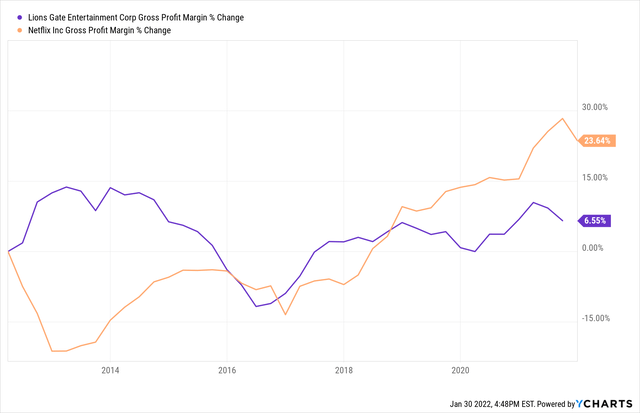

Steady revenue streams are awarded higher multiples by investors and can lead to margin expansion. Take a look at how this strategy has faired for Netflix, compared to Lions Gate (LGF.B). Netflix continues to grow their gross profit margin overtime while Lions Gate is reliant on box office success and Gross Profit margins stagnate.

Gross Margins: Netflix vs Lions Gate

YCharts

Gross Margins: Netflix vs Lions Gate

YCharts

In order to make the Netflix of gaming, you need content, lots and lots of content. And to justify spending a monthly recurring fee to play games you need to offer consumers a similar level of quality to what Netflix delivers for its users.

That’s no small task, it took Netflix decades, and billions of dollars investing into original content to solidify its place in the streaming landscape.

Games, like movies, are expensive to develop… a AAA game can cost as much money as a major Hollywood movie production.

On top of price steep price tag, games can take years of time to build. We have yet to see Grand Theft Auto VI come out yet and GTA V came out in 2013.

So where does that leave Microsoft and Xbox?

Well with a war chest as big as Microsoft, sporting over $100B in liquid assets, that leaves you with one good option: Time for some serious deal making!

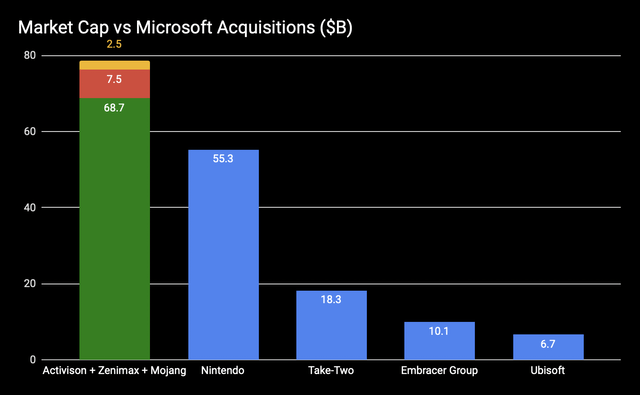

Over the course of less than a decade Microsoft has invested close to 80 Billion Dollars acquiring game studios. To put that in perspective that is nearly one half on Netflix’s current market cap (170B). And is greater than the combined market capitalization of Nintendo and Take-Two (TTWO).

Market Cap vs Microsoft Acquisitions

Created By Author Using Data From Yahoo Finance and Company Filings

Market Cap vs Microsoft Acquisitions

Created By Author Using Data From Yahoo Finance and Company Filings

This has put Microsoft in a unique position, they could become the first and only company within the gaming space that would have enough IP where they could launch a truly disruptive, must have, subscription gaming service.

They could create a true Netflix of gaming. Should they close on Activision Blizzard, Game Pass would be a force to be reckoned with.

Source: Created by Author Using Data From Yahoo Finance

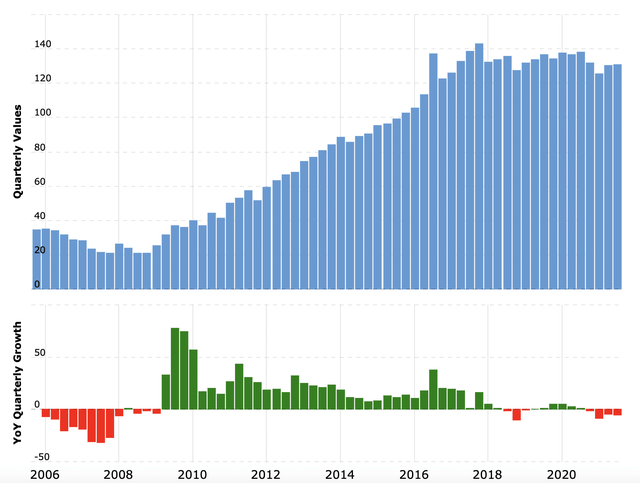

Taking a brief look at their income statement we see consistent growth in revenues, gross profit, and net income. This is as close to a perfect income statement as you can get, consistent growth year in and year out.

Their balance sheet is impeccable as well, they are one of only two companies with a AAA credit rating, the other being Johnson and Johnson (JNJ).

Cash On Hand

Macrotrends

Cash On Hand

Macrotrends

The only complaint I have is the giant cash balance they have which, in this low interest environment, earns next to nothing and is a drag on performance.

One benefit to the Activision Blizzard acquisition is, since its structure as an all cash deal, that it will put a huge dent in the cash balance allowing us investors to earn a real return on that capital.

When I value a company, I typically employ a few different methods to see where those methods point me to in-terms of a fair value for the share price.

Using a basic back of the napkin sum of the parts valuation (ignoring debt, cash on hand, and minority interests) we can see that the valuation for Microsoft is roughy on par with fair value.

Source: Created by Author Using Data From Microsoft’s Earnings Report, YCharts, and Yahoo Finance

With approximately 7.5B shares outstanding that gives us a fair value of ~$310 a share. Incidentally, this is almost exactly where shares trade at as of today January 30th 2022.

Source: Created by Author Using Data From Microsoft’s Earnings Report, YCharts, and Yahoo Finance

Once we incorporate Activision into the valuation we see fair value expands to $2.43T as Activision boosts Microsofts sales and unlocks a reranking for the valuation of their gaming business which is justified due to the recurring revenues gained from a successful Game Pass.

For this valuation I’m only giving them a 6.8 price to sales on their gaming segment, but with strong recurring growth I think a P/S ratio of 8-12 could be argued.

According to my conservative valuation method, each share would be worth ~$325 after acquiring Activision.

Source: Created by Author Using Data From Yahoo Finance

Based on a basic discounted cash flow analysis excluding Activision we see that shares are moderately undervalued. The growth rate of 12% is slower than what we have seen in recent years for Microsoft but closer to their historical average pre-covid.

Source: Created by Author Using Data From Yahoo Finance

If we assume that the Activision Blizzard acquisition will position Game Pass for success it could juice revenue growth and earnings for Microsoft over the next decade. I’m assuming that this will yield an additional 2% revenue growth per year as this service could take on like wild fire.

That brings us to a fair value of $396 a share. Let’s call it $400 because I like nice round numbers.

No investment is without risks and Microsoft is no different.

If Microsoft were to back out of its acquisition of Activision they would have to pay a massive breakup fee ($2.5B). This is a hefty fee to pay, but Microsoft would not have agreed if not for having some assurance that the deal is likely to go through. I will trust management on this one, CEO Satya Nadella has a fine track record.

Another issue to consider is the potential for rising rates to continue to weigh on stock prices. I believe for long term investors it makes greater sense to look for great companies and invest in those versus making a macro call. It’s hard to think of greater company, with stronger fundamentals than Microsoft.

One final risk revolved around execution, if Microsoft acquires Activision and then goes on to remove games from Playstation hardware the potential for a negative reaction could be severe. Gamers are wary of capitalism and major companies exploiting their favorite pastime. EA’s (EA) handling of Battlefront II is a clear example of how greed can lead to poor business decisions that end up destroying value.

Microsoft has kept Minecraft on other consoles which gives me some hope that they would continue to serve the Playstation audience for years to come.

Acquiring Activision Blizzard and integrating their games into Game Pass would unlock massive value creation for shareholders. But even if you believe that the acquisition will not go through then the fair value for Microsoft is around $320 per share.

If you’re a realist and believe that the acquisition will go through and you have modest expectations for Game Pass then fair value shoots up to $360 a share.

If you believe that Game Pass will becoming a smash hit and go on to become the Netflix of gaming the potential price per share is much, much, much higher. Potentially over $400 a share.

The potential reward, given a success for Game Pass, is massive and the risks appear to be marginal.

The market has not yet priced in the potential for Game Pass to truly disrupt the video game industry.

I’m long here. Microsoft is a buy under $320 a share.

As always, thank you for reading. What are your thoughts? Will Microsoft succeed in launching Game Pass or are they doomed to repeat the failures they experienced with the Xbox One?

I try to respond to all ‘constructive’ comments so if you’d like to discuss, let’s chat!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, SONY, AAPL, TTWO, U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.