andresr/E+ via Getty Images

andresr/E+ via Getty Images

In a few weeks I will be headed to Las Vegas to attend several conferences and to celebrate my birthday. I’m looking forward to touring many of the casinos that I own – by way of being an investor in VICI Properties Inc. (VICI) – and to perhaps play a few hands of blackjack.

One of my LLC’s is called “Soft 16 Partners, LLC.” A soft 16 is a blackjack hand that consists of an Ace card and a number 5 card (it can also be made up of an Ace card, a number 3 card and a number 2 card).

The rule to remember is that you should always double down if the dealer has a 4,5, or 6 for an upcard and you have a “soft 16.”

Now, that’s my gambling tip for today, so now let’s move onto more serious investing…

First off, as you probably know, there are three gaming REITs, and soon it will be two. In a matter of days (or weeks), VICI will be closing on the MGM Growth Properties (MGP) portfolio (was announced August 4, 2021) for $17.2 billion (with initial annual rent of $1,099 mm).

iREIT considers the MGP deal transformative, as VICI will pick up 7 iconic Las Vegas assets and 8 other regional assets. Pending the MGP closing, VICI will have well-balanced exposure between the Las Vegas strip and regional markets, including:

Also, VICI’s top tenant concentration will be reduced from 100% at formation in 2017 to 42% pro forma for pending acquisition of MGP, in which 80% of the rent roll is from S&P 500 tenants.

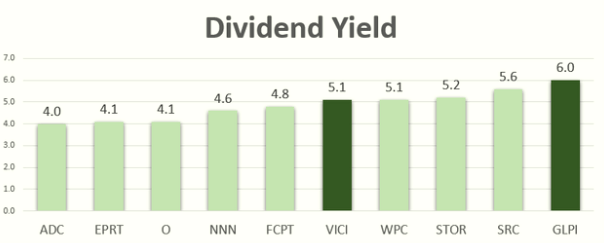

Overall, we like the gaming REIT sector because of the durable cash flow of its triple-net leases, generally solid rent coverage, and above average (and also well-covered) dividend yields.

iREIT on Alpha

iREIT on Alpha

iREIT on Alpha

iREIT on Alpha

We also like gaming REITs because of the asset value upside.

However, one of the biggest risks to the gaming REIT sector these days is the threat of another recession. There remains a lot of debate as to how casinos will manage through the next hiccup.

I was recently reading an article in the Wall Street Journal (by Gwynn Guilford and Anthony DeBarros). The cowriters explained,

Economists see a growing risk of recession as the relentlessly strong U.S. economy whips up inflation, likely bringing a heavy-handed response from the Federal Reserve.

They explain that the economists surveyed by the WSJ put the probability of the economy being in a recession sometime in the next 12 months at 28%, up from 18% in January and just 13% a year ago.

Opinions differ on the source of inflation risk, but most all agree that commodity, food, and gas prices play a part, as well as the raging war in Ukraine.

Keep in mind that during the Great Recession (2008-2009), regional casinos held up better than Las Vegas; however, that may have been significantly affected by the condition of oversupply in Las Vegas (not to mention over-leveraged casino operators), which is no longer the case today.

Also, Las Vegas has since diversified its offerings to attract travel – namely, gaming has declined from 65% of the Vegas business (at the time of the Great Recession), to 35% today (the difference being the expansion into more entertainment, restaurant and convention space).

Still, there remains a lot of debate about how casinos of all types will manage through the next recession, on the view that no two downturns are alike.

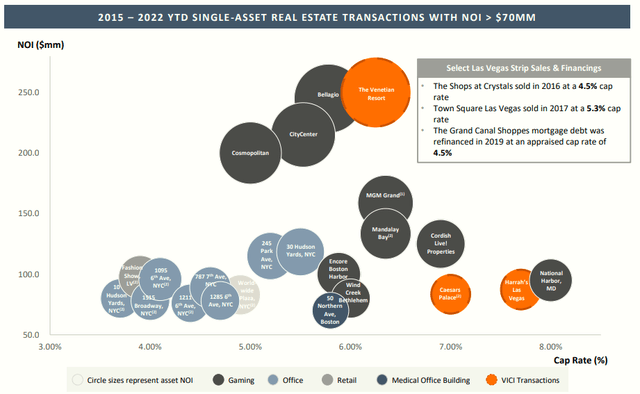

We think this persistent question is a contributing factor behind gaming casino cap rates remaining high relative to most other commercial real estate property types.

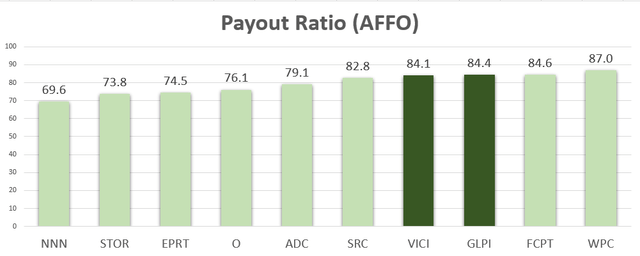

As viewed below, gaming revenue was 50% less volatile than S&P 500 revenue (during the Great Recession).

VICI Investor Deck

VICI Investor Deck

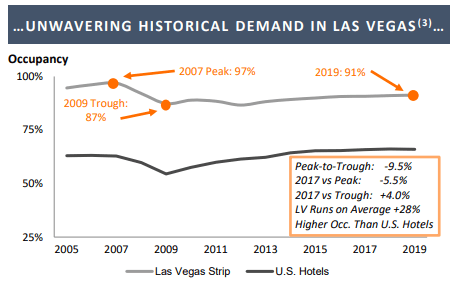

In addition, Las Vegas maintained strong demand in 2008-2009 (as seen below).

VICI Investor Deck

VICI Investor Deck

Our view is that gaming REITs will not be impacted in the next recession, and remember that there’s a very good chance that the Federal Reserve will be able to rein in inflation without triggering another recession. That’s what economists call a “soft landing.”

(Ha. I was able to use the word “soft” again after previously referencing “Soft 16”).

Let’s now take a look at two of our favorite gaming REITs:

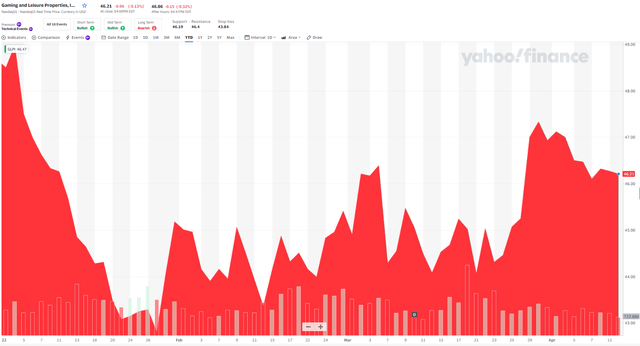

GLPI was the first gaming REIT that was created from a tax-free spin-off of the real estate of Penn National Game in February 2013. We like the 100% regional focused model (zero on the Las Vegas strip) and diversified portfolio that spans 25.6 million square feet across 51 properties in 27states. As viewed below, GLPI shares are down roughly 5% YTD.

Yahoo Finance

Yahoo Finance

GLPI’s largest tenant is Penn National Gaming and affiliates (PENN) (74% of revenues), which formed GLPI in a spin-off transaction in 2013. The company’s major tenants are credit worthy public companies with strong balance sheets, institutional platforms, extensive experience, and established brands.

In the latest earnings report GPI announced full-year 2021 AFFO of $3.44/share which was in line with the previous year. The company also announced the acquisition of three gaming properties in Maryland, Philadelphia, and Pittsburgh from affiliates of Cordish for $1.8 billion.

On April 1st, GLPI announced that it had completed the previously announced acquisition of the land and real estate assets of Bally’s three Black Hawk Casinos in Black Hawk, CO, and Bally’s Quad Cities Casino & Hotel in Rock Island, IL, for $150M. The transaction was announced las year and shows GLPI’s ability to execute on acquisitions in the gaming space.

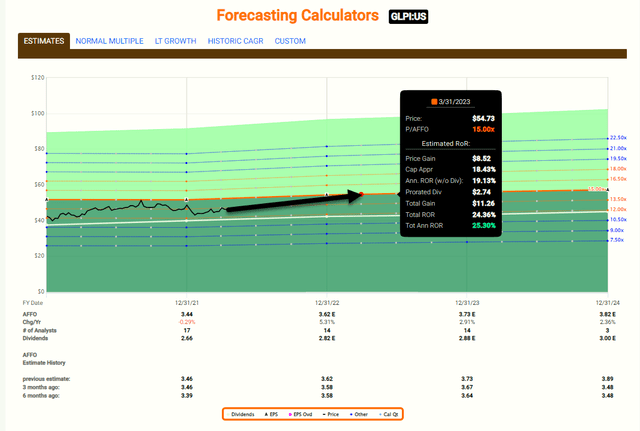

GLPI trades at an attractive multiple of 13.2x P/AFFO. To put that into perspective, GLPI’s closest peer, VICI, trades at 15.3x (p/AFFO). With Realty Income Corporation (O) now “in the game” for casinos (more on that later), I expect to see more deal flow in the sector. Perhaps GLPI become a takeover target. GLPI also declared a first quarter dividend of $0.69/share, up 3%.

GLPI closed at $46.21/share and is currently trading as a buy. Our 12-month total return target is 25%. Also, analyst growth estimates for GLPI are 5.5% in 2023.

Fast Graphs

Fast Graphs

VICI’s portfolio is comprised of 28 properties, including Caesars Palace Las Vegas, Harrah’s Las Vegas, and the Venetian Resort. These are three of the most iconic entertainment facilities on the Las Vegas Strip.

As noted above, any day now we expect VICI to close on the MGP transaction that will add another 15 properties to the existing portfolio. This transformative deal will enhance VICI’s geographic and tenant diversification, that should also result in an upgrade to investment grade (later in the year).

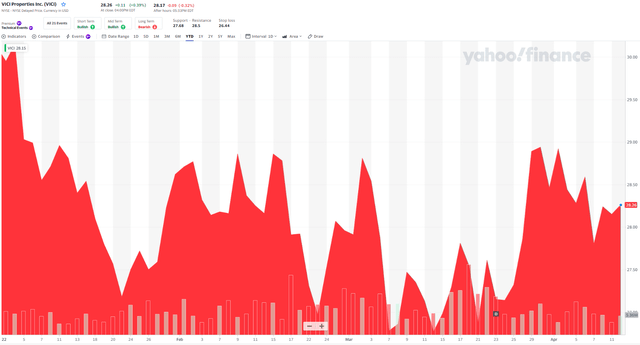

VICI was created on October 6, 2017 as a spin-off of certain real estate assets operated by Caesars (as part of the reorganization coming out of the Caesars’ bankruptcy). VICI executed an initial equity private placement in November 2017, and its IPO came shortly thereafter, on February 1, 2018. As viewed below, VIC shares are down ~6% YTD.

Yahoo Finance

Yahoo Finance

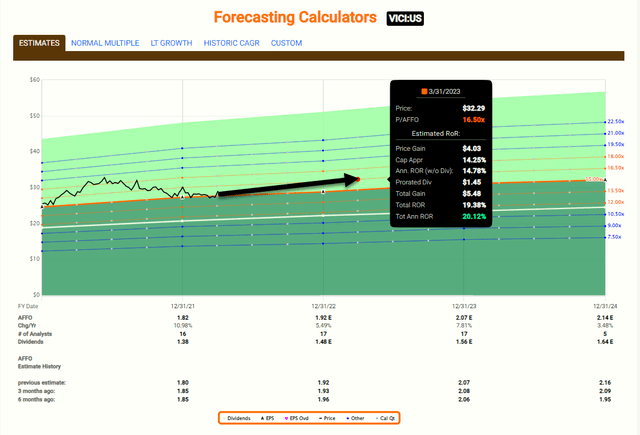

VICI grew earnings (AFFO per share) by 11% in both 2020 and 2021, and analysts expect the strong earnings growth to continue, with expectations for 6% and 8% growth in 2022 and 2023, respectively.

VICI currently has a dividend yield of 5.1%, and shares are trading at $28.26. This is below our buy-below target of $36.00. Historically, shares have traded at a 16.5x (based on AFFO) and are now trading at 15.3x.

We also think there’s some room for multiple expansion for VICI (and GLPI) as investors warm up to this unique sector and the validation (of gaming assets) by Realty Income.

Fast Graphs

Fast Graphs

It’s important to recognize that the US gaming business is characterized by high levels of state regulation that often create barriers to entry. This also introduces a unique level of transparency, as the states require real-time updates on the health of the business.

We consider this a “wide moat” attribute…

The gaming market remains highly fragmented, as there are roughly 475 commercial casinos in the US. This provides an opportunity for REITs (and private equity owners) to participate in the ongoing opportunity to utilize sale/leasebacks for expansion.

Also, beyond casinos, we expect the gaming REITs to explore other areas such as hotels, convention centers, and stadiums. VICI has already ventured into other “experiential” segments such as amusement parks and golf entertainment facilities.

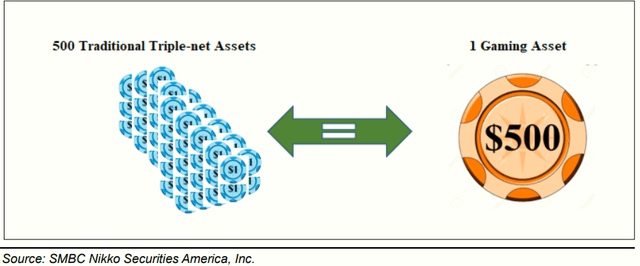

Although the number of available casino properties is still small compared with conventional free-standing net lease assets (i.e. dollar stores, drugstores, etc..), the total size of casinos is an important consideration.

For example, it takes as many as 500 drug store purchases to equal a single casino, such as the $4.25 billion purchase (by Blackstone) of the Bellagio. Individual transactions naturally take longer to close, and cap rates remain attractive.

Most importantly, the earnings needle moves much faster with a trophy trade, which is one of the reasons we recently saw Realty Income put a few chips on gaming.

SMBC

SMBC

Recently, Realty Income announced it was acquiring the Encore Boston, a trophy Wynn property that cost $2.6 billion to build. Realty is buying it for $1.7 billion, far below replacement cost, and that equates to a 5.9% cap rate for a Class A property.

Due to Realty Income’s low cost of capital (WACC is ~4.25%), this deal is expected to generate strong investment spreads. It would have taken the company 1,700 Advance Auto stores (at $1 mm per copy) to generate the same earnings growth.

I would not be surprised to see the company pursue the same type of sale/leaseback arrangement with Wynn in Las Vegas. The casino is worth around $2.7 billion and sits on 215 acres directly across from the Fashion Show Mall.

As seen below, these gaming assets are perfectly suited for the larger net lease REITs like O and VICI, that have the capital and scale to acquire these trophies.

VICI Investor Presentation

VICI Investor Presentation

The Realty Income deal with Wynn is not expected to close until Q4-22 (due to license approvals), and I’m confident that this will not be the first gaming deal for “the monthly dividend company.”

Think Europe too!

So, when I’m in Vegas in just a few weeks, I’ll be touring many of my trophies (owned by VICI). As I stare at the “soft 16” on the blackjack table, I’ll remember to always double down…

PS: Deep diving coming soon on O!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Banks, and we recently added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research («WMR»), a subscription-based publisher of financial information, serving over 6,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha). Thomas is also the editor of The Forbes Real Estate Investor and the Property Chronicle North America.

Thomas has also been featured in Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox. He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, and 2019 (based on page views) and has over 96,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley).

Disclosure: I/we have a beneficial long position in the shares of O, GLPI, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.