PC Gamer is supported by its audience. When you buy through links on our site, we may earn an affiliate commission. Learn more

By published

The GPU shortage appears to be easing, but are we out of the woods yet? I talk to an expert.

If there’s one single event that has impacted PC gamers in the past year and a half more than any other, it’s the semiconductor shortage. What might have otherwise been a far-off issue for most was brought home to our gaming PCs by a complete lack of the latest graphics cards available to purchase at a reasonable price. But as stock appears to improve in 2022, and prices are starting to drop, you have to wonder whether it’s all getting better already.

«I do think that things are better.»

Well, is it? It’s not a question easily answered by anyone but there are those in the know with a better idea of what’s going on. That’s why I’ve had the pleasure of once again speaking with Dr. Thomas Goldsby, the Haslam Chair of Logistics at the University of Tennessee’s Master’s of Science in Supply Chain Management online program.

Last time we spoke we were in one of the worst periods of shortages for GPUs, but this time things are looking up, and I want to know whether a certified supply chain expert like himself also feels like the situation is improving.

«I do think that things are better,» Dr. Goldsby says. «You may recall that we broke the problem down in terms of supply and demand. And most people focus on the supply part, but you cannot overlook the demand implications a pandemic when people were altering lifestyles, altering work, play and entertainment.

«And that certainly led to this incredible surge for all things electronic, but on the supply side of things it also affects us in our ability for people to show up to work, to feel confident in the work that they perform.»

Between the last time I spoke with Dr. Goldsby and now, the new variant of the Covid-19 virus, known as Omicron, surged across the globe. Some areas still have high cases of Covid-19, including Hong Kong, which has led to lockdowns and similar measures in China’s high-production and shipping areas. However, many restrictions and measures for mitigating Covid-19 have since been lifted or removed.

«By virtue of Omicron presenting this ugly head and fortunately starting to relent. It helps us on both sides. It helps us in terms of people getting back and starting to live a little bit more in a sense of normal life. And then also our ability of our supply chains to perform at a kind of pre-Covid level. And so there is some normalising, which I think would help to explain why maybe supplies a bit improved, maybe prices are starting to relent a bit.

«I am seeing some glimmers of hope, just as you are,» Goldsby continues.

That insight might help to explain why graphics card stock levels have appeared to increase in recent weeks. However, prices have yet to drop to their MSRPs with this new influx of cards.

«I would expect prices to come down when it becomes apparent that supply is catching up and that they are readily available,» Goldsby says. «A supplier out there will get nervous that they are sitting on considerable supply for an item that has a limited shelf life (with newer cards entering the market) and will make the move to clear out that excess inventory.

«Peer suppliers will then have to follow that lead. And back to equilibrium we fall.»

What we cannot discount is the apparent falling demand from other GPU users, largely cryptocurrency miners. The past few years have been mighty profitable for cryptocurrency miners, or at least those with cheap enough electricity, and that has seen them snap up graphics cards for profit. That is still often a viable option today, but there’s no denying that the profitability of ethereum mining especially has dipped for most, which may have seen a dip in interest for brand new gaming GPUs.

«Just how much stuff including hardware, including electronics, do we need?» Dr. Goldsby says. «You can look at some interesting segments: Peloton did the exercise bike—did they think that every household was going to have two Pelotons? I don’t know, but that market kind of saturated and people realised, ‘oh, I guess I can get out and ride a real bicycle. I don’t have to be captive to my basement or something.’

«You know, you just kind of reach a point of saturation. And that’s true with any product, it’s only going to be appealing to a certain subset of the population. And once they get theirs, you know, they’re kind of happy.»

This also comes down to the Bullwhip Effect, which says that small increases in demand will be interpreted as much larger than they are once they get further down the supply chain. You know, like a whip: from a small movement results a loud crack.

Customer demand must be forecast by the retailer, distributor, and manufacturer. Since demand is rarely static, there’s a relative imbalance at any point during the supply chain. Sometimes you won’t really notice it as a consumer, when supply chains aren’t in crisis, but when they are you may find yourself paying more attention to the ebb and flow of supply.

I think folks have just started to kind of come to grips with the fact that you can’t just snap your fingers and produce or deliver a product.

«The other one is something I find fascinating, I was teaching this with my students last night in class, is an 11-year aged Tennessee whiskey. That’s a tough one to forecast, because the stuff you’re putting in a barrel today, you’re not selling until 2033.»

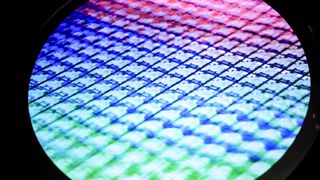

Now think of a graphics card supply chain. These PC components have thousands of components and not all sourced from anything close to a single supplier. The chip, the capacitors, the MosFETs come from various locations around the world and are assembled into a single unit someplace else. These make not only forecasting for demand difficult, but it’s also not an overnight job to suddenly adjust production to compensate.

«I think folks have just started to kind of come to grips with the fact that you can’t just snap your fingers and produce or deliver a product. It takes an incredible amount of planning and execution to pull that off. It’s a simple premise, but anything but simple to execute.»

This is especially true of high-performance computer parts, and no more so the GPU. The prime component in our PCs for performance today, these are also often some of the most dependent on cutting-edge process nodes. Those of which are in incredible demand. CPUs, too, are often at the whims of the latest 7nm, 5nm, 3nm process nodes, which AMD often champions with its Ryzen processors built in TSMC’s fabs, though Intel is also making significant progress towards catching up with new fabs in the US and Europe.

«It’s among the slowest forms of production to change,» Dr. Goldsby says. «… you announce that you’re going to embark on a new fab, and maybe three years from now you’re actually producing chips, in good quality. So some things just can’t turn on a dime. And certainly high tech among the toughest.»

Though Goldsby’s words are hardly an indictment of any improvement to the market we’re seeing today. TSMC chairman Mark Liu today noted that it appears consumer demand for electronics is starting to slow, and UK retailer Box told our friends at TechRadar that it expects «things to return to a more attractive price» by the end of April/beginning of May.

During my regular rounds of browsing the web for graphics cards in stock and at a decent price, I have begun to notice a gluttony of GPU stock at most major retailers. The decent price bit is usually missing, but they are dropping a touch in that regard. And if this level of stock can be maintained, price drops are sure to follow.

There are signs of improvement in terms of semiconductors generally, and that’s promising for graphics card supply in 2022. Though for all these heartening signs, we are still not out of the woods yet. GPU prices remain above MSRP and major chipmakers, such as Intel, have voiced their concerns of tight supply until the lights flicker on at their new fab facilities, and those like them built by competitors.

«It’s kind of a neat example where having the vision of a problem led them to innovate in very meaningful ways,» Goldsby says.

But just as much so are technology and automotive companies looking into ways to shore up their supply chains and get as much of their supply chain in-house or close to it as possible.

«As a friend of mine reminds me, every business decision we make virtually manifests in the supply chain. And I think that CEOs have realised that hey, you know, supply chains aren’t just the things that we say, ‘hey, produce this product and do it at this cost.'»

«Experts have to be privy to, and be participating in the conversation, about what products we devise, how much it’s realistically going to cost, and what are the prospects for actually being able to deliver those products.»

Can we avoid a semiconductor shortage in the future? Only time will tell, but our brush with flaky supply over the past few years has shown how reliant we are on these clever blocks of sand. Graphics cards being just one part of a wider industry shaken by global events, and all will no doubt be taking note of how to avoid the worst of it in the future.

In the here and now, I wanted to ask Dr. Goldsby one last time if he believed everything would come back to pre-pandemic supply.

«We’re reading the same things you are, you know, particularly as I look at gaming systems and semiconductor, they’re saying that 2022 is going to continue to be a challenge, probably into 2023. These are going to be certain sectors that are just going to take longer than others. And for the reasons we discussed earlier, I do think that, you know, consumer electronics are going to tend to lag a bit.»

«The true test may be, in your world, when someone can go into a store just routinely and see a PS5.»

«I think the only the only X Factor is the pandemic. As the pandemic goes, so go our supply chains.»

Heaven forbid that happens. Though without anything of the sort, there is word of favourable winds coming from the big gaming tech companies.

Nvidia has recently pushed a more favourable opinion of supply in 2022, saying that by the second half it expects significant improvements. Though generally Intel and TSMC, the companies making these chips, have been more conservative about a major adjustment in their ability to meet demand, saying 2023 looks more likely.

AMD has said that it is spending big to «satisfy the demand out there», making significant investments in wafer capacity, assumedly with TSMC, that should materialise with next-generation Zen 4 and RDNA 3 chips.

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

Of course these companies are far more in the know that us, though as I’ve mentioned forecasting for customer demand is near-enough augury at this point. So when will we know when it’s all coming up rosy for PC hardware? Well, perhaps the availability of consoles could be of some assistance there.

«The true test may be, in your world, when someone can go into a store just routinely and see a PS5,» Goldsby says. «What I’m gathering the bots are going out and buying up everything, and they end up on the secondary market at much inflated prices. So as soon as someone can just wander into a store and go, oh, there’s a PS5, I’d like to get one of them.»

It sounds like a pipe dream but perhaps we’re not so far away from this reality as some may think. Let’s just hope we’ve learned what we can, become more robust, and can navigate our way to a more fruitful PC gaming landscape in a matter of months, rather than years.

Jacob earned his first byline writing for his own tech blog from his hometown in Wales in 2017. From there, he graduated to professionally breaking things at PCGamesN, where he would later win command of the kit cupboard as hardware editor. Nowadays, as senior hardware editor at PC Gamer, he spends his days reporting on the latest developments in the technology and gaming industry. When he’s not writing about GPUs and CPUs, you’ll find him trying to get as far away from the modern world as possible by wild camping.

Sign up to get the best content of the week, and great gaming deals, as picked by the editors.

Thank you for signing up to PC Gamer. You will receive a verification email shortly.

There was a problem. Please refresh the page and try again.

PC Gamer is part of Future US Inc, an international media group and leading digital publisher. Visit our corporate site.

© Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.