Television engagement dropped month-over-month in February as it always does, even with some major TV events during the month, and videogaming continued to grow its share of overall TV time.

The February dip in TV engagement was even bigger than usual, according to «The Gauge» from Nielsen, its monthly macro look at TV delivery platforms. January was a five-week month in the company’s measurements, including the heavy TV week after Christmas, and in part thanks to that, February sequential viewing was down 5.7% vs. a typical 5% drop.

That came in spite of February TV events including the Super Bowl and Winter Olympics, along with a late-month surge in cable news linked to geopolitics and Russia’s invasion of Ukraine.

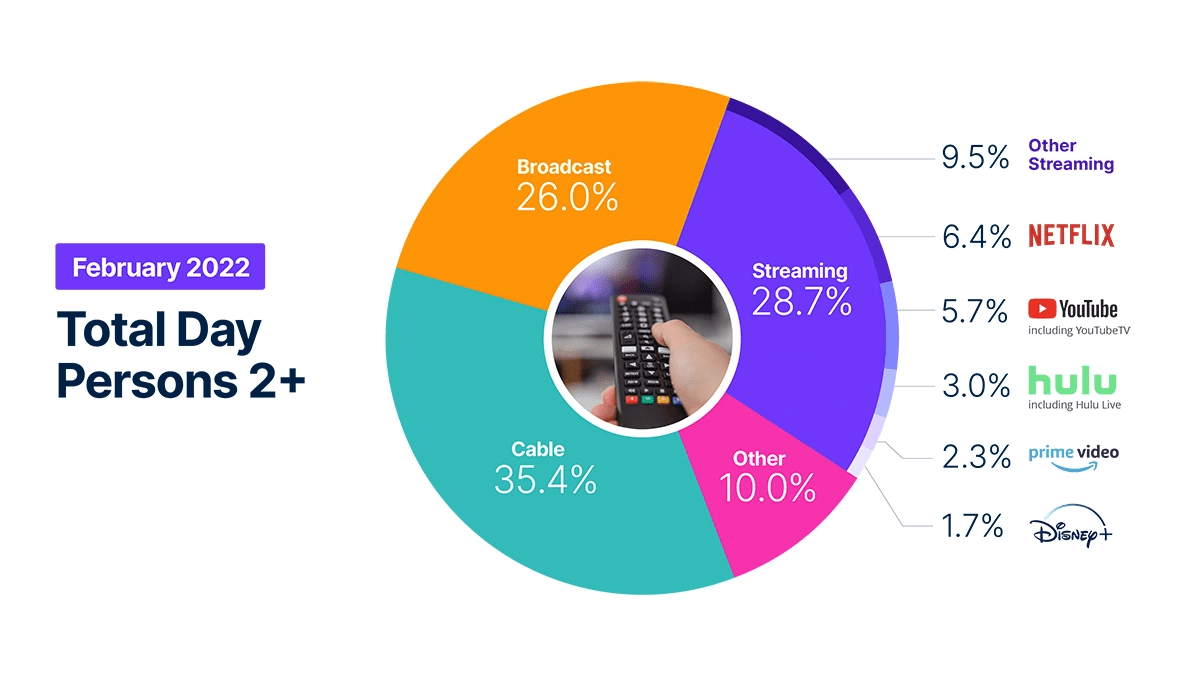

In terms of share of time, the three biggest categories each gave up a bit. Broadcast’s share of TV time dipped to 26.0% from January’s 26.4%; Cable dropped to 35.4% from last month’s 35.6%; and after a year of on-and-off growth, Streaming dropped to 28.7% share from 28.9%.

Those dips were made up by the «Other» category, growing almost a full point to 10% and heavily representing videogames. («Other» includes activities like watching video discs along with gaming.)

Another school holiday in the President’s Day weekend offered more time for gaming, which took a dip when school started in the fall before surging over the holidays. And the month saw some highly anticipated new game releases, in Elden Ring and Horizon: Forbidden West. (See the February videogame sales rankings here.)

Of Streaming’s 28.7% share, the interesting tidbit is that leading streamers – Netflix (NASDAQ:NFLX), Amazon Prime Video (AMZN) and Disney+ (NYSE:DIS) – shed some more share that was picked up by «Other streaming,» which includes niche services as well as linear streamers like Spectrum (CHTR), DirecTV and Sling TV (DISH).

Netflix’s (NFLX) leading share of overall TV time fell to 6.4% from 6.6%; YouTube and YouTube TV (GOOG, GOOGL) held steady at 5.7%; and Hulu (DIS, NASDAQ:CMCSA) held at 3.0%. Prime Video (AMZN) fell to 2.3% from 2.4%. And Disney+ (DIS) dipped to 1.7% from 1.8%. «Other» streaming, meanwhile, rose in share to 9.5% from 9.4%.

Pay TV distributors: Comcast (CMCSA), Charter (CHTR), DirecTV/U-verse (T), Dish Network (DISH), Verizon FiOS (VZ), Optimum/Suddenlink (ATUS), Atlantic Broadband (OTCPK:CGEAF), Sparklight (CABO).

Relevant local broadcast tickers: Nexstar Media Group (NXST), Sinclair Broadcast Group (SBGI), Gray Television (GTN), Tegna (TGNA), E.W. Scripps (SSP). National broadcasters: ABC (DIS), NBC (CMCSA), CBS (NASDAQ:PARA, PARAA), Fox (FOX, FOXA). And some ad-tech names tied to connected TV: The Trade Desk (TTD), Magnite (MGNI), PubMatic (PUBM), Criteo (CRTO), Roku (ROKU).