ANGHI/iStock via Getty Images

ANGHI/iStock via Getty Images

As Seeking Alpha’s resident GameStop (NYSE:GME) bear and longtime critic, I am well aware of the company’s off-beam $6.9 billion valuation. I also recognize the large and somewhat unexpected 400 basis point gross margin compression seen during this past holiday quarter, as well as the tens of millions of dollars in new core expenses over the last half of 2021. But with that as a preface, and despite the ugly headline earnings loss, the recently announced holiday quarter results had the best news for the company’s operating fundamentals since the announcement of the strategic partnership with Microsoft in 2020.

Surprisingly, GameStop appears to have sold more games to more gamers. This is despite the ever-present secular trend to digital download and live services, as well as some technical issues working against software sales related to the console cycle. And what is more important, for the first time leadership openly recognized and adequately articulated the key mistake of prior management.

We have learned from the mistakes of the past decade when GameStop failed to adapt to the future of gaming… We’ve also had to change the way we assess revenue opportunities by starting to embrace, rather than run from, the new frontiers of gaming.

CEO Matt Furlong, Q4 2021 Results – Earnings Call Transcript, 3/17/22

Software Sales

(Holiday Quarter)

PowerUp Rewards Members

Paying (Year)

[Both data are in millions. *The 2017 & 2018 Software Sales shown above are meaningfully skewed lower due to current reporting methods. Sourced from Form 10ks.]

So one may rightly ask, what is the big deal about $55 million in top-line software growth when there was a $148 million loss for the quarter? Further, one may question the importance of a small gain in the content category relative to the substantially larger declines witnessed over the past few years (see table above). But importantly, it is a reversal against the heretofore strong downward secular trend. Its importance and details are considered below.

First, the base gross profit percentage of the software category, before any shipping costs assumed by the company, is two to three times higher than in the hardware category. Historically, gaming software was the primary contributor to the gross profit dollars. So a GameStop turnaround can’t just be focused on expanding low margin hardware SKUs and must be predicated on recapturing share of gaming content sales.

Further, these software revenue gains of about 7% during the 2021 holiday are meaningful because they do not appear based solely on a cyclical boost. Looking back, one may have expected a strong cyclical boost in software to accompany the strong 2020 holiday launches of the PS5 and Xbox Series X/S. Company proponents from a year ago will well remember how GameStop focused on bundled sales of the hot consoles. Because extraordinary demand outstripped supply, players often accepted a higher price point that included software or accessories just to obtain the underlying box.

And there was also the notion that the excitement of the period drove both interest and foot traffic; recall that players often camped out overnight prior to a console supply drop. Surprising to some, software sales were down 25% that quarter.

The secular/cyclical/new strategy dynamic is complicated. Factors like ongoing changes to the install base mix can ramp total software demand over the early years of a hardware cycle, though these effects were obscured by other facets during the last cycle. And of course, during the first year of a new cycle the majority of content sold is still for prior generation equipment.

But as discussed below, though there are these other factors pushing and pulling, one can be somewhat certain that GameStop’s Q4’21 software growth reversal was not due to attachments to newly sold consoles. And this shows some lack of reliance on the console cycle itself and is the first positive sign for how new management is executing their strategy.

It is important to stress that GameStop had become such a cyclical business and so capital starved that we have had to rebuild it from within.

CEO Matt Furlong, Q4 2021 Results – Earnings Call Transcript, 3/17/22 (link above)

The next console cycle’s temporary sales bump is not a justification for complacency and glacial transformation.

Ryan Cohen, Maximizing Stockholder Value by Becoming the Ultimate Destination for Gamers, 11/16/2020

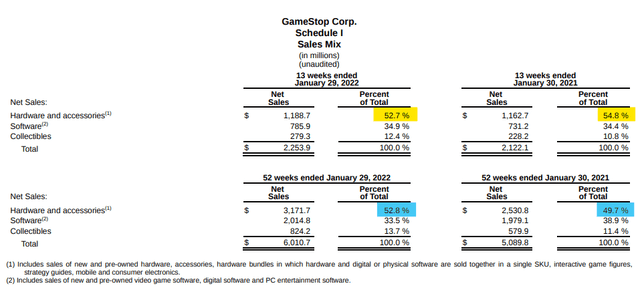

In the graphic just below note that total hardware net sales were up a relatively small $26 million or 2% during the 2021 holiday quarter. And interestingly, as an aside from this main point, note the hardware category represented slightly less share of the mix, down 2% (seen in yellow).

Category Mix (GameStop)

Category Mix (GameStop)

We continued to establish new and expanded brand relationships, including with PC gaming companies such as Alienware, Corsair and Lenovo. This helped grow our PC gaming sales by 150% for the full year. We also formed a partnership with Razer to support sustained growth in PC gaming and console accessories such as controllers and headsets. We now have more than 100 Razer SKUs, including the company’s latest laptop.

CEO Matt Furlong, Q4 2021 Results – Earnings Call Transcript, 3/17/22 (link above)

Because hardware sales are almost flat and the company stressed that gaming PC sales contributed meaningfully to growth, it is likely console sales were down at GameStop during the 2021 holiday. And this fits well with general reports that industry-wide gaming hardware, which is predominantly consoles, was down 15% during GameStop’s Q4 period.

Lastly, GameStop also bucked the general content sales trend among the industry at large with their 7% gain. Over the November through January period, NPD had total content revenues flat to down low single digits.

Take this picture as a whole, including the 2019 and 2020 holiday data, and couple it with other data such as growth in paying PowerUp Rewards members; the company likely counteracted the strong downward secular trend in their software sales beyond the aid of what Cohen calls the cyclical «bump». GameStop simply sold more games. Of course, this needs confirmation in the coming quarters, especially as it was not seen in the second and third quarters when software sales were basically flat year-over-year.

But looking forward, is it possible to reconcile GameStop’s possible earnings with its valuation? The table below games out a possible earnings scenario. Revenue growth in 2021 was about 18% and one could legitimately argue a large part of the growth came from the reversal of Covid effects felt in 2020. Setting this aside, assume revenue growth of 35% to $8.1 billion.

The gross profit percentage in 2021 was 22%, though the trend in the second half of the year was down, primarily on added shipping costs assumed by the company. Setting this aside, assume a 22% gross profit margin is maintained. SG&A for 2021 was up 13% to $1.7 billion. Even normalized for seasonality, the rate of increase was strongest in the second half of the year. Setting this aside, assume SG&A remains near $1.7 billion.

The result of these assumptions is $100 million of hypothetical earnings. So, even if the $1.27 billion cash balance were backed out of the $6.9 billion market cap, the price to EBIT multiple would remain above 50. GameStop is substantially overpriced even under the most optimistic of near-term outlooks.

Author’s note: there is a lot of interest and excitement surrounding GameStop’s upcoming launch of an NFT digital asset marketplace. My take can be found here. One thing to consider is that the revenue and earnings potential being shared by company proponents likely proves optimistic.

Time after time we have seen forecasts missed. For example, recall the Technology Brands projections and collectibles (p.16) projections. In more recent events, 2020 brought a wave of detailed, professional projections and due diligence forecasting the console cycle’s effects on GameStop’s business for the 2020 holiday quarter and the full-year 2021. Across the board, the models failed spectacularly to accurately estimate revenues or operating earnings. Even the most bearish cases proved to be hundreds of millions of dollars per quarter over the actual results. This failure casts doubt on the validity of the underlying presumptions.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.