DenisTangneyJr/E+ via Getty Images

DenisTangneyJr/E+ via Getty Images

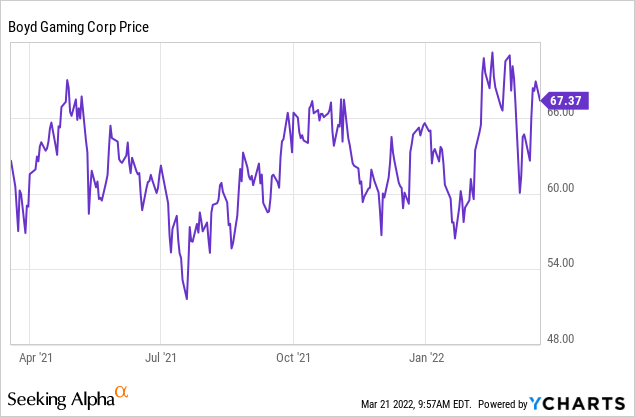

It’s getting late, but it’s time to buy Boyd Gaming Corporation (NYSE:BYD) which has been knocking it out of the park way before Covid, staying tough during Covid, and poised to break through to new highs as we approach the Covid endgame. I have long been a fan of this company for reasons both apparent—its performance—as well as those not really understood by investors—its customer ethos.

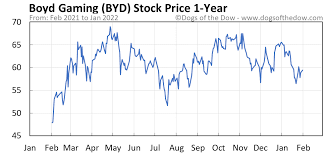

Price at writing: $68

Most investors today, whether admitting it to themselves or not, are attention span challenged by the massive daily flood tide of news, data and analysis pouring into their eyeballs and ears. So what they understandably do is cling ever closer to time tried metrics that measure valuations. One clearly can get bogged down with the plethora of numbers and technical analysis metrics that can give anyone a case of MEGO fast (My Eyes Glaze Over) when appraising the value of a stock.

But too much information is likewise subject to the laws of diminishing utility: the more you absorb, the less trenchant to a conclusion the latter sequential value of the info. Becoming a real student of a stock or a company brings context to an investing decision. Unfortunately, too many investors in gaming stocks who think they understand a company, with all due respect, really do not. What is rarely baked in these days, even after the great wisdom of the work of arbitrageur Nassim Nicholas Taleb’s books. According to Taleb’s Fooled by Randomness (2001) book and many thereafter, sheer random luck is as responsible for investing success as any finely tuned command of metrics. So much for ultra sophisticated fine-tuned algorithms.

google

We’ll get to the most impressive numbers of this company later in this article to bring down the conviction that yes, BYD is undervalued by many metrics. But first, context from a gaming industry veteran’s viewpoint–myself. I’m not promoting it as a gospel. I am not chiseling the ten commandments of why one should be in BYD at near its 52-week high. There are no magical powers involved in my assessment. Just what 35 years in the business at the C-suite level has enabled me to absorb into my bones, right or wrong.

One of the first and most durable lessons I learned all those decades ago came from a guy who was indeed one of the reigning geniuses of this business: Mr. Steve Wynn. His followers were many of the operators who ran and run companies on the Vegas Strip and all over the nation. The look of the Vegas Strip today in many ways is a Wynn creation.

Here is the first and only commandment Wynn chiseled into the tablet of my gaming mind:

The casino business is an art, not a science.

We use science when we can, but in the end, it is the artistry of what we create for customers and the style in which we deliver it that is the dividing line between the sheep and goats of profitability. And the art of the business can only come from one source, knowing customer well.

No better epitome of this virtue can be found in the annals of this business than that of Mr. Sam Boyd (1913-1993), legendary founder of The California Club and Sam’s Town in 1975 with $10,000 saved from his years dealing roulette in Reno, Tahoe and Vegas.

BYD archives

BYD archives

Above: Where it all began. The much expanded, reliable moneymaker in the Vegas locals market known as Sam’s Town.

Even before that, Sam ran gambling ships off the LA coast and bingo joints in California. (Wynn ran his father’s bingo halls in Maryland on vacation from his Wharton classes. These skills Sam easily transferred to Las Vegas, specifically the locals market where the company began and where it still has a huge footprint till this day.

Here’s the secret sauce of the art: In the Las Vegas locals business, you have just about the toughest customer base in the nation to service. You are dealing to people predominately in the business in one way or another. They expect superior, friendly “home town” levels of service. They are frequent players. They are players needing cultivation over many trips. They know the drill backwards and forwards and play the comps game with great skill.

Wynn once told me who he saw as the savants of this business, among them Benny Binion (Horseshoe) and a man named Sam Boyd. He was a marketing innovator and established a foundational service culture that, difficult as it is, still permeates the giant BYD. It’s no easy task.

Excelling in face to face customer service from one or two Vegas locals casinos is a far simpler span of control challenge than it does for a 28 property national branded portfolio. And therein lies the art. It’s not perfect. As someone who has mulled over thousands of customer comment cards in my own career, I realize slip-ups are inevitable as the span of control stretches through a system.

An example of their deep wellsprings of operational savvy comes with the history of BYD’s entry into the Atlantic City gaming market in 2003 as a 50/50 partner with MGM in the Borgata property on the marina. BYD managers broke all the conventional wisdom rules of the market: No crazy mass bus programs to drain profitability, no chasing business because they put the marketing as such into the walls, as Steve Wynn once told me.

Every dollar you spend in so-called excess on the design and amenities of a property that rises above competition is that much less you have to keep spending to incent people to come to your joint, not someone else’s.

In 2016, BYD, having made Borgata the #1 market leader in AC, sold its share to MGM (MGM) for $900m and used the proceeds to add to their Vegas locals portfolio. So smart asset allocation is another signature skill set BYD management has brought to the competitive party. At the heart of Borgata’s AC success was the Wynn commandment of not merely building a better mousetrap, but building the best mousetrap.

Borgata was built for $1.1b and expanded with another $600m putting its in-the-ground cost at $1.7b. During its 13 years under BYD, it was a positive contributor to BYD’s bottom line and earnings every year once it built up a head of steam.

google

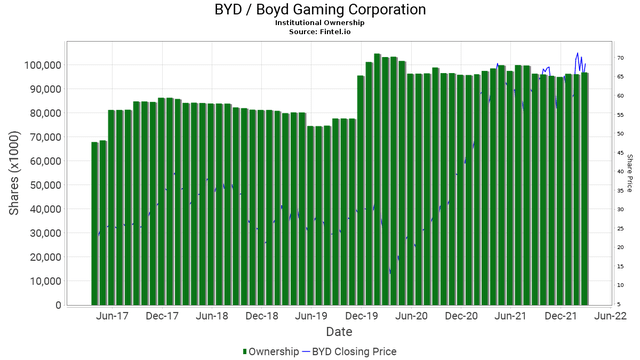

Above: Institutional ownership reflects high conviction about BYD’s outlook.

So add it up: Enter the market at the right time, build the best property, learn from the mistakes of competitors in the market, and leave when the time is right.

The property was a customer favorite, attracting younger demos without neglecting the core AC 55 and older slot player.

I’m not implying BYD never experiences complaints about lousy service, cheap comping, rude employees, etc. Casino customers are vocal. But overall, my quiet on-the-ground research into the average daily operations of BYD properties over time is highly positive. These guys know their stuff. And that is why I believe you want to be in business with them at its current price.

Amplifying this conviction is the fact that the core segment of BYD’s business, and that of its US regional peers, is the slot business of the 55 and over demo. Covid has kept these players away from casinos for nearly two years. It’s been stop-start. But the Wall Street Journal today reported that older Americans are beginning to return to their favorite leisure activities with confidence that the health risks in the main are behind us.

google

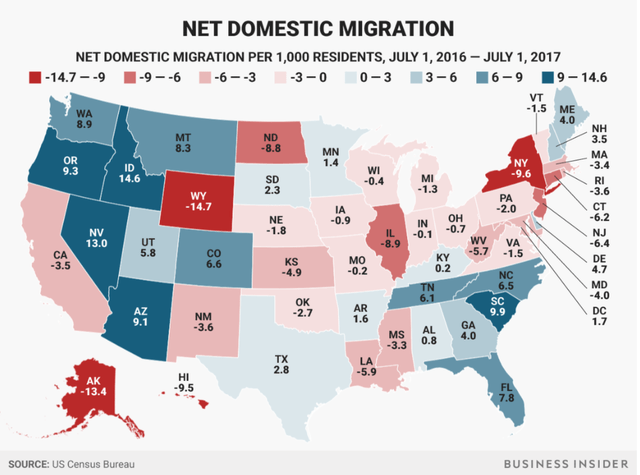

Above: Nevada is one of the strongest net population gainers in the US.

BYD will report earnings next about a month from now. My expectations are:

Total 2022 earnings: $6.32

Revenue: $3.8b based on my calculation of the pandemic endgame and growing arrivals of 55+ slot play at BYD regional as well as continuing solid performance in Vegas locals markets, suburban and downtown.

Analyst forecast of sales growth 2021 sits at 7.9%, taking the pent-up demand factor into consideration. But they then see that falling to 2.70% for this year as demand settles into a more normalized pre-Covid pattern.

Operating margin history tells a story of consistent focus shows that between 2015 and 2019 BYD margins grew from 23.5% to 27.36% (ttm) this year.

Return on assets (ttm) 9.01%

ROE (ttm): 3.48%

Debt profile (ttm)

Total debt: $3.93b

Cash and equivalents: $345m

Current ratio: 0.91

Revenue base balanced reveals master strategic goals

2021 revenue by segment 2021

Las Vegas Locals: $886m. Key: A tough customer market but a robust economic growth picture due to expanding arrival of service industries in Clark County. Add younger retirees and millennial families fleeing deteriorating lifestyles in major metro areas around the nation.

Downtown Vegas: $155m. Sam Boyd was a pioneer in cultivating a sustained, long term growth based on Hawaii tourism. That plus strong property product downtown, gives BYD a leg up on the gaming segment which showed a higher percentage revival than has the strip to date.

Midwest and South: $2.3b

So roughly one third of BYD revenue comes from Nevada and two thirds from Illinois, Kansas, Louisiana, Mississippi, Missouri, and Pennsylvania. Total rooms: 11,000.

What is at work here is conviction of continuing economic and population growth in Nevada plus a regional geographic footprint in most well developed gaming markets in the Midwest and South, neither of which is as oversupplied for the foreseeable out years as is the northeast. That segment of the nation is losing population at a rapidly increasing rate accelerated by the pandemic. We expect that trend to continue, adding value to properties BYD operates in those states with first class properties.

Sports Betting: BYD’s B Connected sports betting mobile app is marketed in partnership with its prior “bro” MGM, as well as deals with FanDuel. It is not part of the expensive treadmill to oblivion marketing spend of its mainstream competitors. BYD see sports betting as a valued amenity for their retail sports books, a service for their mobile customers—not a headlong run for the roses to capture meaningful shares of market in pure sports betting.

Price targets

Analyst consensus is looking for $80 a share. I think it’s a realistic number for certain. But after my own analysis with input from my industry colleagues in markets where BYD operates, I calculate earnings performance coming from pent-up demand sequentially ahead to produce stronger EBITDAR returns this year.

On that basis, I am looking for BYD to crack $90 by the end of this year, or by Q1 ’23.

This is a fair question to raise here: Why should I own BYD as opposed to the single wallet giants? Why is BYD a buy without a massive digital presence as are Caesars Entertainment (CZR), MGM Resorts International (MGM) and Penn National Gaming (PENN)—all stocks I also continue to see as bullish going forward.

The answer is you buy each one as a somewhat different bet.

In CZR, you are betting on its sheer scale as the biggest guy on the block, all-in on sports betting with a commitment to reduce marketing spend. You buy MGM for its US as well as international footprint: US regional properties, two properties in Macau, still in the game for Japan downstream and among the most aggressive pursuers of sports betting market share. In PENN, you have a similarly solid US regional brick-and-mortar profile, plus a far greater digital ambition than BYD.

In BYD, I see a pure-play in US gaming, a company with superior management history, a strong customer service culture and a track record of smart asset allocation. I do not believe BYD is anywhere near done moving its capex around, adding to its portfolio or even a possible merger downstream. This is a management and board that are the antithesis of the sleepwalkers that are the natural prey of activists like Carl Icahn. BYD should be equal weight in a diverse gaming portfolio as it is among the sleep-tight entries in the sector now trading at a very attractive price.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress «The Smartest ever Guide to Gaming Stocks» – free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.