Believe_In_Me/iStock Editorial via Getty Images

Believe_In_Me/iStock Editorial via Getty Images

The biggest risk to tech stocks in 2022 are business normalizations from COVID-19 pull forwards. The chip sector faces a normalization of PC sales this year, but Advanced Micro Devices (AMD) won’t be impacted to any great extent due to supply constraints holding back prior year sales. My investment thesis remains very Bullish on the stock after this sell-off to $120.

Analyst Harsh Kumar downgraded AMD last week on fears of a slowing PC market. Piper Sandler placed a $130 target on the stock after AMD had topped $160 a few months ago.

If the chip company was just a cyclical play on PC demand, the call would be concerning. The whole story on AMD is a secular shift in demand to their higher performance chips with market share taken from industry giant Intel (INTC). AMD has been supply constrained for years, so any sales issues at the margin will hit the chip giant with AMD selling all the chips the company can get TSM (TSM) to produce.

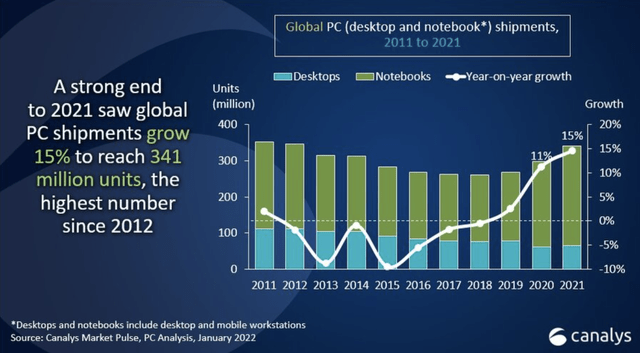

My investment thesis is definitely in agreement with the call on slowing PC demand. According to Canalys, the PC sector saw strong sales in 2020 and 2021, leading to sales growth of 27% above the 2019 levels to reach 341 million units.

Canalys

The sector hadn’t seen growth in years, so one shouldn’t assume these levels of sales should persist going forward. Enterprises and individuals buying extra PCs for WFH environments won’t be in the need of new computers for years.

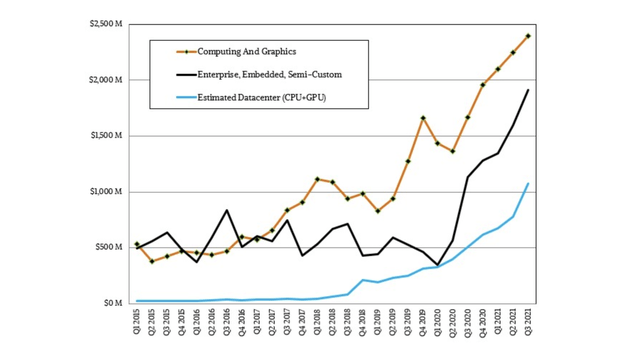

AMD obtains a large portion of sales from CPUs sold into the PC sector. The company just highlighted a massive amount of deals in the laptop division to support growth this year. A combination of CPU/GPU sales amounted to Q3’21 sales of $2.4 billion with the majority of quarterly sales from CPUs for PCs.

Next Platform

Clearly, what happens in the desktop and laptop segments are very crucial to the success of AMD. The market expects AMD to continue growing datacenter chip sales from just over $1 billion this quarter to multi-billions per quarter in future periods.

While the PC sector could face a period of fewer units sold in 2022, AMD has been supply constrained for years. At the Credit Suisse conference back in late November, CEO Lisa Su highlighted how AMD was poised to maintain 20% growth targets and take more share in the high performance end of the PC segment:

And we said with Xilinx, we expect to continue that 20% CAGR. And from what we see, we see that that’s absolutely achievable. From a supply standpoint, from a demand standpoint, from a customer standpoint, I think there’s a lot of desire to expand where we are positioned in the market and we’re putting on all aspects of the supply chain to ensure we can do that.

There’s no question the last two years were very strong for PCs. I think as we go into 2022, we’ll see exactly how the supply chain — the total supply chain shapes up for the PC market. But overall, I mean, 350-plus-or-minus million units is a great market. And we see within the market as well, there is a preference for higher performance, more capability, more graphics capability, more integration capability. And all that plays into our strength of really driving sort of a stronger mix within the PC market as well.

For these reasons, AMD is likely to sell far more chips into the PC segment in 2022. Intel faces a scenario of losing sales to both AMD and Apple (AAPL) selling their Macs with the new M1 chips replacing Intel chips. The scenario is dire for Intel considering Apple is the one growing market share the fastest with 9% growth in Q4’21.

Clearly, the slowing PC market isn’t a major concern for AMD yet. Analysts forecast sales jumping 19% to $19.2 billion in 2022, but the chip company appears clear the goal is to exceed 20% growth.

Analysts have EPS targets of $3.35 in 2022 and $4.14 in 2023. As mentioned by Piper Sandler, the Xilinx (XLNX) deal only provides minor accretive benefits by now, with their business only growing 10% annually this year after AMD hit 65% growth in 2021.

AMD has become cheap now trading under 30x 2023 EPS targets. AMD should maintain EPS growth rates in the 25% range due to the fast revenue growth. The stock is a bargain trading at a P/E multiple close to their EPS growth.

The key investor takeaway is that investors should watch the growth rates in the PC segment, but AMD is likely to continue taking market share in the higher performance segment. Along more market share in the fast growing datacenter segment, the chip company is poised to maintain fast growth in 2022. The stock remains too cheap here with the growth opportunities.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during 2021, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.